The Advantage of Vertical Integration in a Competitive EV Market

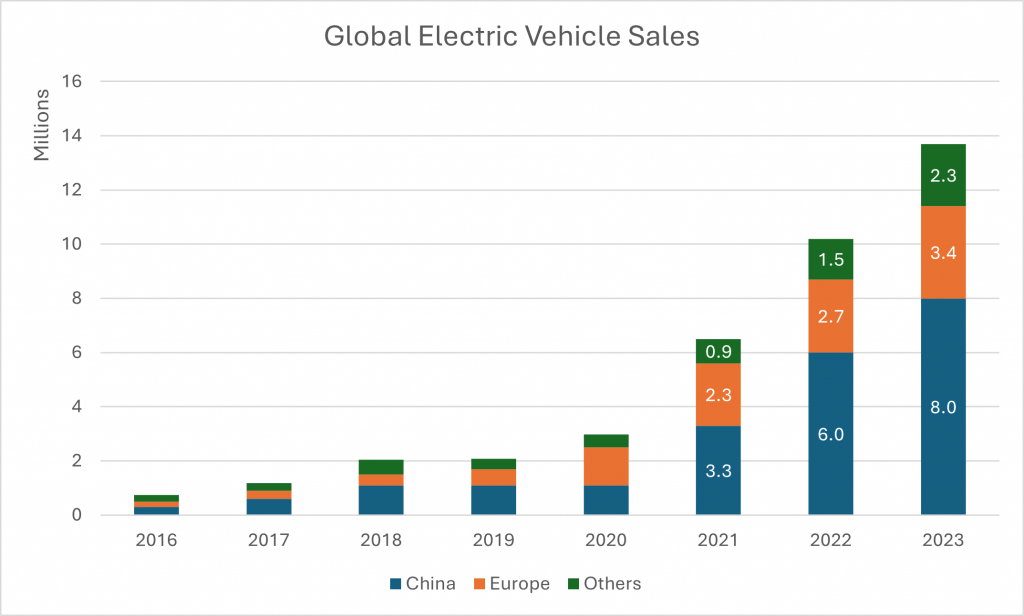

22nd Feb 2024, Manama: The market for electric vehicles (EVs) has been growing at a CAGR of 53% over the past decade, with around 13.7 million electric vehicles sold in 2023, up a staggering 34.2% from 10.2 million in 2022. These growth rates have been primarily driven by regulatory changes that subsidize and push for the sale of electric vehicles over conventional vehicles, such as the European Union passing a law to end the sale of new CO2-emitting cars by 2035, and the goal to reach net-zero by 2050. Similarly, subsidies have been the primary reason for higher adoption of EVs across the world.

However, we believe that the subsidy model though good in the short term to drive adoption, it is not sustainable in the long term due to higher financing burden on the government. Also, as economies reach closer to their net zero targets the production of ICE (Internal Combustion Engine) models will eventually stop and only EVs will be available in the primary market. Hence, in the long term if we take subsidies out of the equation, the OEM sector will be a level playing field and we believe that only the most competitive OEMs typically which are vertically integrated would be able to grow or sustain their market share.

Source: International Energy Agency

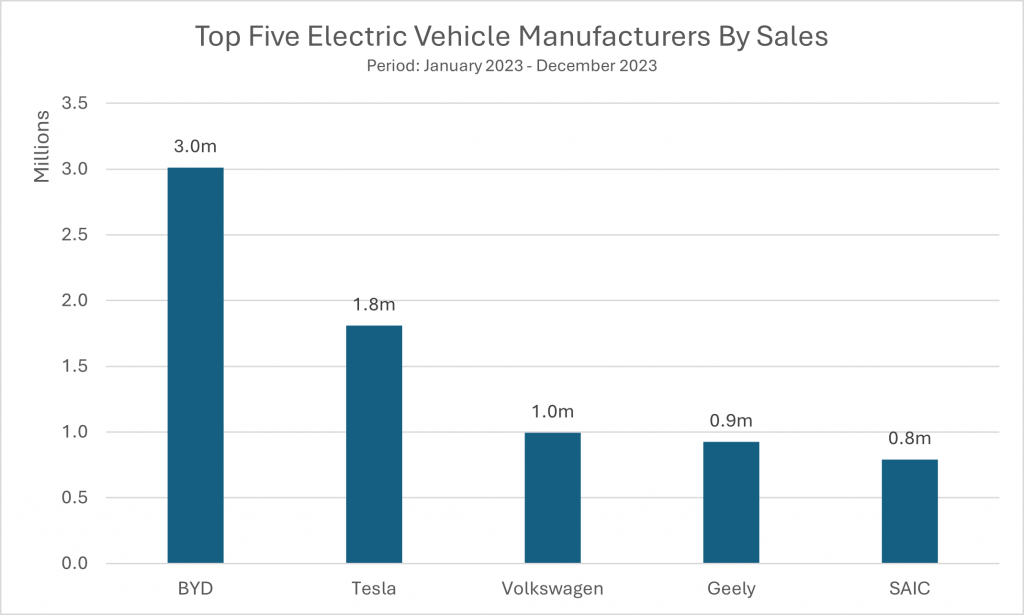

In terms of automaker sales, three of the top five manufacturers are of Chinese origin, the biggest seller of which for 2023 was BYD (HKG: 1211), with over 22% of the total sales of EV globally. The EV sales of BYD were 1.6x the second-best EV OEM Tesla and 3x the sales of the European auto giant Volkswagen.

Source: EV-Volumes.com

The high market share for BYD can be attributed to a certain extent to its extremely competitive pricing. For example, let us consider two prominent EV models, the Volkswagen ID.4, a mid-sized electric crossover, starts at 40,335 EUR, while the BYD Song L, a Chinese mid-sized electric crossover, starts at 189,800 RMB or almost 24,700 EUR, a price tag that is around 60% of its western equivalent. High prices remain one of the major challenges for faster EV adoption globally.

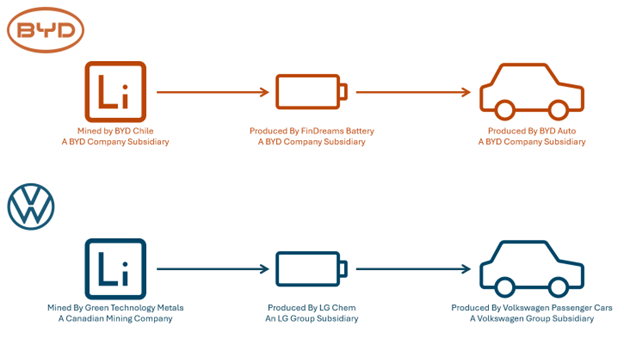

China is known for its manufacturing cost competitiveness and in case of BYD it is not merely due to economies of scale but also due to its significant control over the entire value chain of their EVs production. The batteries that power BYD vehicles are manufactured in-house by BYD, using lithium mined by a BYD subsidiary. This allows them to achieve lean production costs, contributing to a lower priced final product. It is also worth noting that BYD started as a pure battery manufacturing company, so it naturally had an advantage and control over battery production. At the same time, if we consider Volkswagen, the battery production is outsourced to LG Chemicals hence we believe the cost delta between battery and powertrain cost of BYD and that of Volkswagen could be quite meaningful.

Source: Company Reports, Bloomberg, Reuters

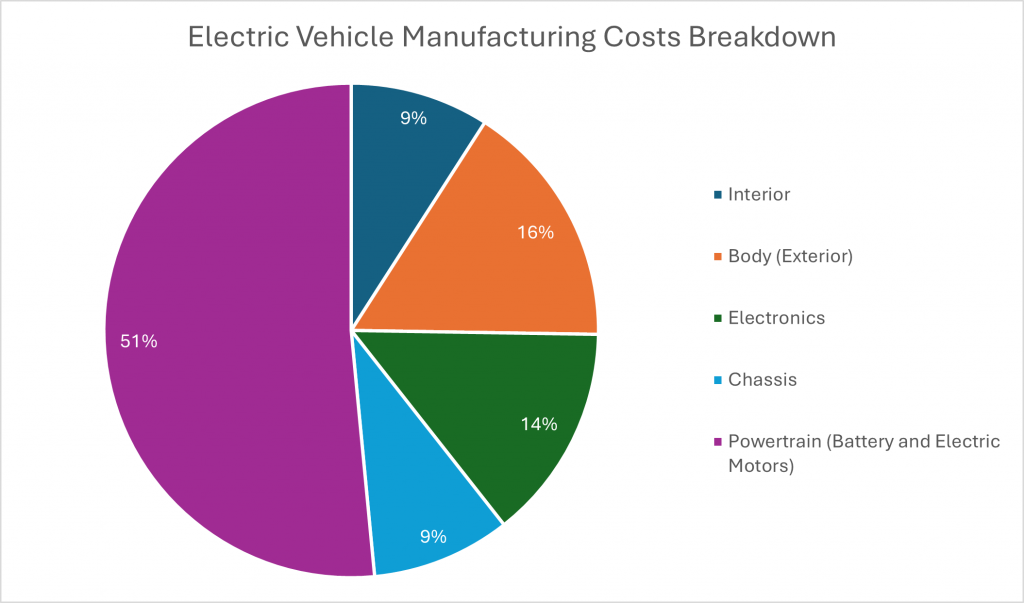

It is further important to note that battery and powertrain accounts to 51% of the total production cost of an EV hence controlling this part of value chain could be strategically important for OEMs. Another incumbent Tesla has set up Gigafactories around the world for similar reasons, to control and own the quality of the value chain.

Source: InsideEVs.com

Due to its lower cost, imports of EV auto parts from China into the EU rose meaningfully over the past few years impacting the local OEMs and prompting the European Union to launch an investigation into Chinese electric vehicles and their subsidies. Potential tariffs from the investigation could have a significant effect against Chinese imports, given the size of the market and its rapid expansion.

An important takeaway from this case study is the production of EVs will be largely democratized and expected to be more competitive in the years to come, however only the companies with significant vertical integration would be able to innovate and remain price competitive at the same time. Hence, we believe incumbents would have an advantage over new entrants only if they are able to establish control over the value chain.

Contact:

Yusuf Ahmed

Jr. Investment Analyst

yusuf@mef.bh

+973-1711 1700

Jinesh Rajpara, CFA

Investment Advisor

jinesh@mef.bh

+973-1711 1703

Disclaimer: The information on this document should not be construed as legal, investment, financial, professional or any other advice. Content on this document does not represent or constitute any solicitation, inducement, recommendation, endorsement or offer by M E & F Holdings W.L.L. or any third-party service provider to buy or sell securities, commodities, digital assets, or any financial instruments. Nothing on the document constitutes professional and/or financial advice. The views expressed on this document are only of the author(s) and does not necessarily reflect the opinion of any other third party.