The performance of the US economy under different administrations has long been a subject of debate, and with a major US election happening this year, the topic of which political party can lead the economy better seems more relevant than ever. Our research has shown that Democrats have historically managed to lead a better economy over Republicans, and this was done through their management of both the private and public sector.

It must be noted that Republicans had the onset of financial crises develop within their term, which possibly skews their performance when compared to Democrats. However, the fact that financial hardships are more prone under the republican party cannot be easily ignored either.

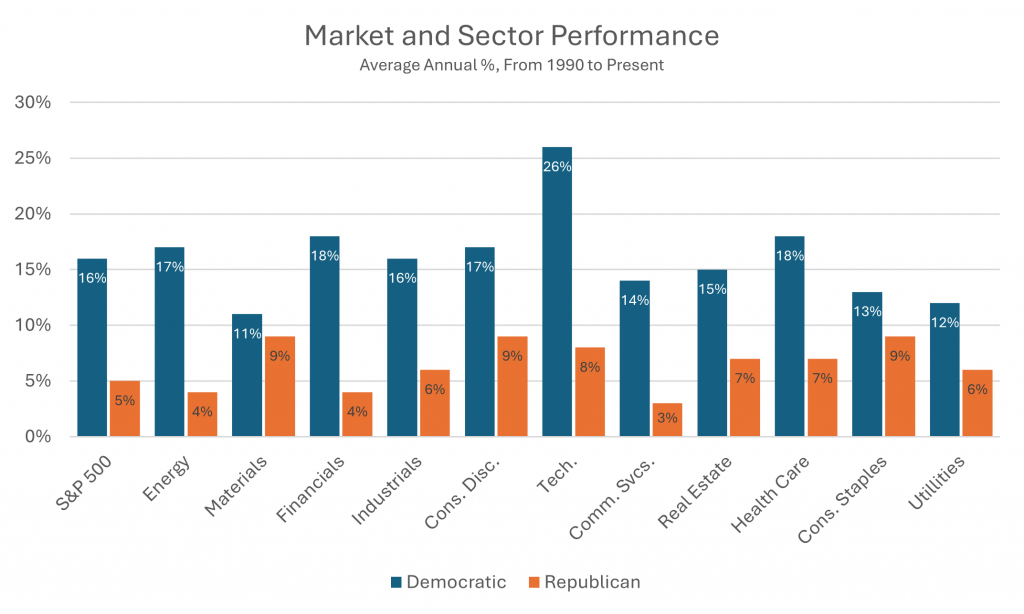

Exhibit 1:

Source: J.P. Morgan Asset Management

The overall US market and its sector have tended to perform better under Democrats, and that is also pointed out in Exhibit 1, which shows average market and sector performance under both administrations in office since 1990, the chart clearly shows democratic presidents have had an edge in both overall average market performance and on a sector basis as well, with their averages outperforming republican averages on the S&P 500 and every single sector over the covered period. However, it must be noted that the 2008 financial crisis, which was under a republican president during its onset, does negatively skew some of the republican figures.

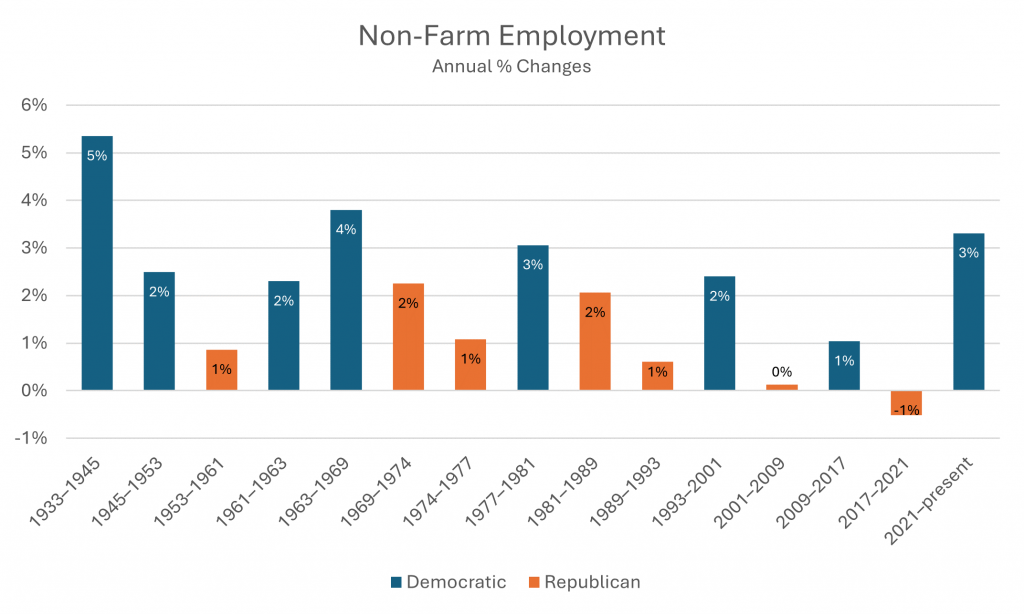

Exhibit 2:

Source: U.S. Bureau of Labor Statistics

Another factor Democrats have historically dominated in was unemployment, which plays a major role in a country’s economic performance. Exhibit 2 presents the average annual change in non-farm employment under different presidential terms, the exhibit shows a similar pattern to how markets performed, in that with a Democratic president, the US had higher employment, and hence a lower unemployment rate.

This is consistent with the better economic performance seen under Democrats; reduced unemployment gives them higher total factor productivity performance, which could also lead to better consumer expectations, thereby aiding economic growth.

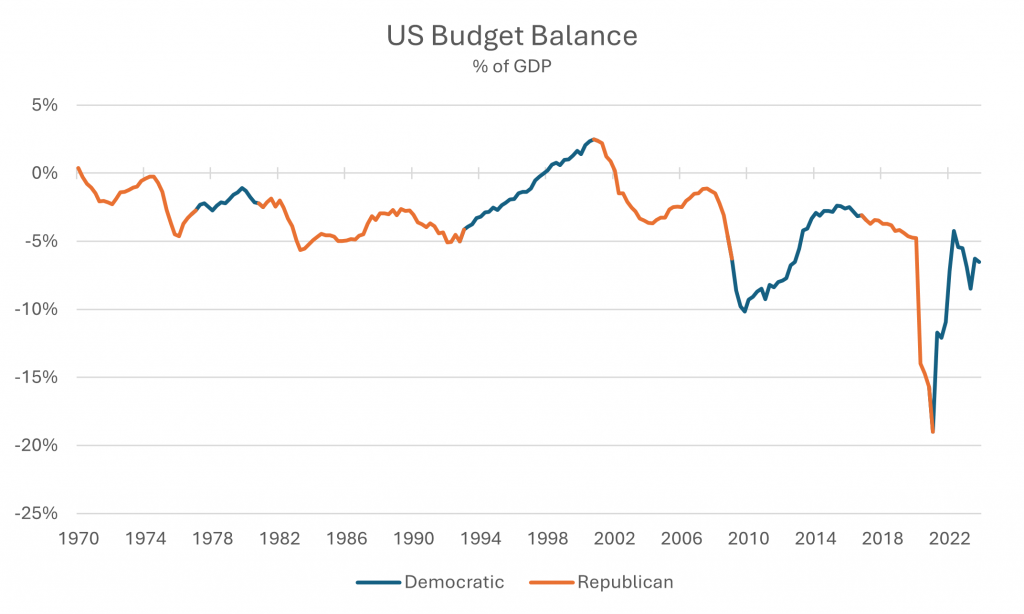

Exhibit 3:

Source: LSEG Workspace

Another edge Democrats have maintained over their terms has also been their maintenance of the federal budget, in this case measured by the budget’s surpluses and deficits, both metrics that historically shown a specific pattern between both political parties. Exhibit 3 indicates the US budget balance as a % of GDP over the tenure of 6 US presidents, the chart shows republican presidents have historically pushed for widening budget deficits, which could be attributable towards either lower government receipts from tax cuts or heightened government spending, whereas periods with a democratic president, which tend to push opposing policies to republican ones, have experienced decreasing deficits, with the only fiscal surplus in the last 50 years coming under the tenure of a democratic president.

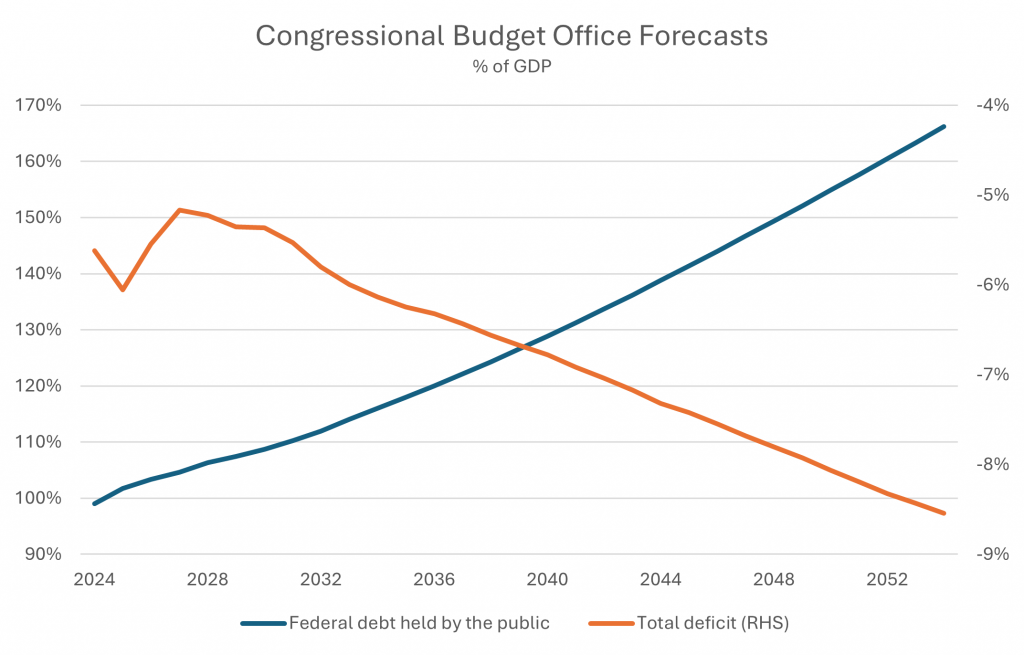

It must be noted that US federal debt levels have been rising at a heightened pace recently, with federal debt held by the public as a % of GDP projected to reach 116% from 97% within 10 years from 2024 according to the latest long-term budget outlook issued by the Congressional Budget Office (CBO). Deficits were projected to steadily increase from 5.62% of GDP as of now to upwards of 8.54% by 2054 as pointed out in Exhibit 4.

Exhibit 4:

Source: Congressional Budget Office

Furthermore, rate cuts were expected this year but the pace at which they are likely to materialize will be slower compared to the hikes, this leaves the Federal Reserve stuck in a conundrum of having to manage current inflation levels and waiting for unemployment to increase before cutting rates.

Looking forward with the upcoming presidential election in mind, the current president in office, Joe Biden, will soon end his term leaving the US in a state of economic fragility as the president led the economy through the end of the COVID-19 pandemic and into a high-interest rate environment. These results have shifted opinions towards favoring the republican nominee, Donald Trump. However, with years of history backing the republican party’s tendency to push for spending and borrowing, the US may enter a phase of further economic hinderance based on the historical performance of the party.

In conclusion, the US economy tends to favor democratic presidents in office, and in turn, democratic laws and bills, as economic performance for both the private and public sectors tended to outperform during those times. Republicans, on the other hand, have historically shown underperformance during their terms in both the private and public sectors as well.

Contact:

Yusuf Ahmed

Jr. Investment Analyst

yusuf@mef.bh

+973-1711 1700

Mohamed Ali

Jr. Investment Analyst

mohamed.ali@mef.bh

+973-1711 1700

Disclaimer: The information on this document should not be construed as legal, investment, financial, professional or any other advice. Content on this document does not represent or constitute any solicitation, inducement, recommendation, endorsement or offer by M E & F Holdings W.L.L. or any third-party service provider to buy or sell securities, commodities, digital assets, or any financial instruments. Nothing on the document constitutes professional and/or financial advice. The views expressed on this document are only of the author(s) and does not necessarily reflect the opinion of any other third party.