With the growing rift between the trading relations between China and the US, the developed world is feeling its domino effect. Close US allies, mostly in the EU have started raising concerns about the Chinese dominance in certain sectors which has negatively impacted domestic industry. For example, the recent increase in duties for Chinese cars.

While Chinese goods can break the market due to oversupply and penetrative prices, they can break the markets with undersupply as well. Reckon the intense lockdowns in China during the COVID-19 pandemic which disrupted the supply chain and shot up prices of essential goods.

So, the real question is, is moving away from China sustainable or even attainable for the developed world? While there is no straightforward answer to this seemingly direct yet deep question, we have attempted to analyze how much financial leverage China has in addition to trade leverage. In a world where its largest two economies are engaged in trade wars, understanding the relative strength of one versus the other is paramount and could give us some direction into how geopolitics and the new world order could evolve.

72% of the countries on the planet are indebted to China in the form of loans or project financing: China’s growth story has been unprecedented over the past two decades, the gross domestic product of China was $1.2 trillion in 2000 vs. ~$18 trillion in 2023, a staggering 15x increase. As the country independently grew stronger, China deepened its influence over the world in the form of direct financial aid, bailing out weaker economies or infrastructure project financing. Considering the same time frame of the past two decades, the Chinese aid amounted to $1.2 trillion for 140 countries in the world representing 1.2% of the world GDP.

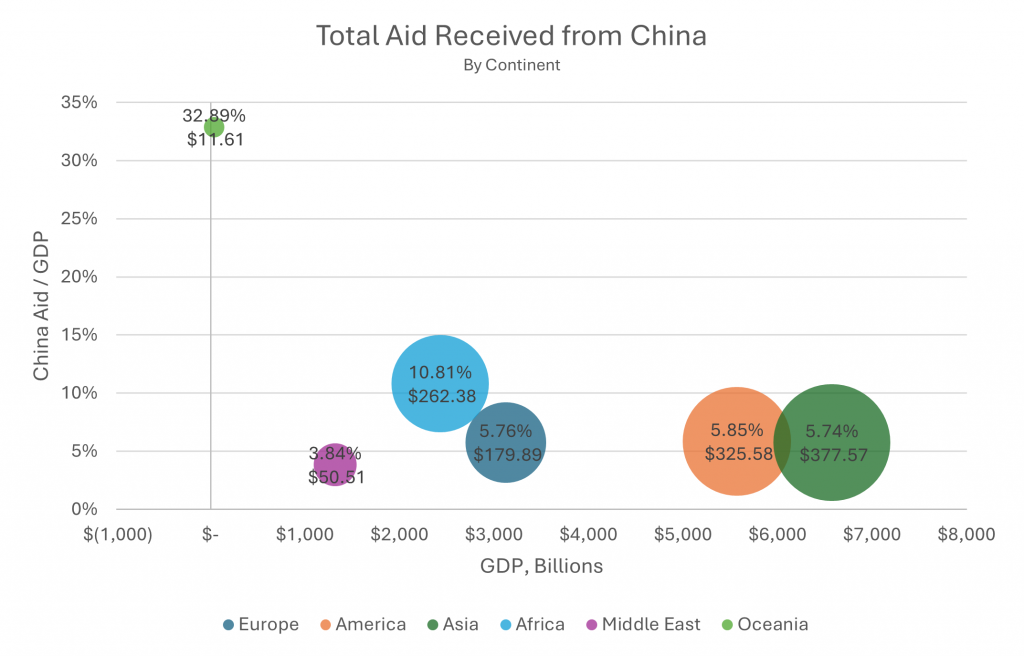

Zooming into this total pie provides us further insights, considering a continental cut of the pie we notice that most of the aid has been provided to the Asian countries, amounting to $378 bn, followed by America and Africa with $326 bn and $262 bn respectively, refer to Exhibit 1 below. It is important to note that all the countries in the American continent are central or southern American nations. The Middle East received $50bn worth of aid and Oceania received $12bn, the lowest among all. Investment in Asia also aligns with China’s national and strategic interest to remain a dominant force in its continent. It also aids in its ambitious Belt Road Initiative of connecting Asia to Europe via a road network. The absolute numbers of aid can be well complimented with the proportion of aid with respect to the continent’s total GDP.

Exhibit 1:

Source: Aiddata.org

Apart from the Middle East, each continent has received more than 5% of its GDP as financial aid from China. Oceania ranks highest with 33%, largely due to its low GDP base and developing nature of the economy. Africa stands at 11%, it is a significant proportion and strategically important one because Africa has the largest natural reserves for important and rare minerals on the planet. In contrast to the absolute amount of aid, the proportion of the aid to the GDP for America and Europe is slightly higher than that for Asia. However, it is important to note that most of the countries in Europe are central or eastern European countries.

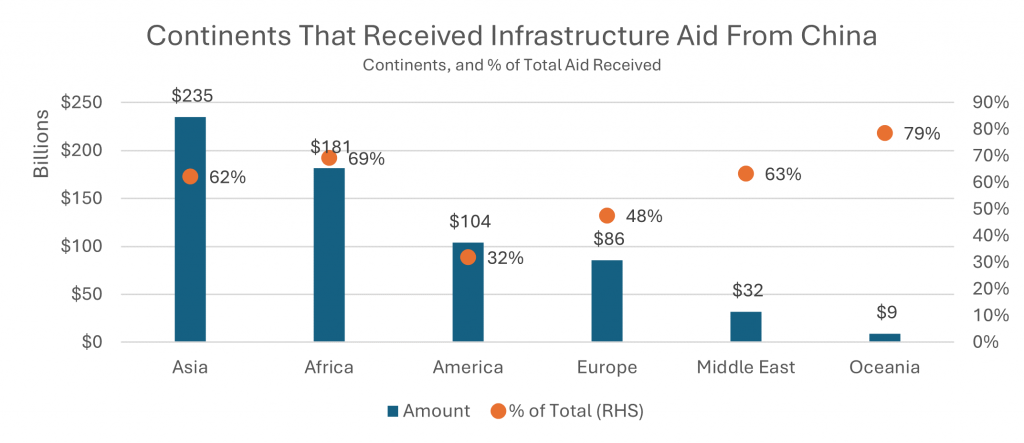

Analyzing further highlights more insights concerning the type of aid. Out of the total $1.2 trillion worth of aid, $647bn (54%) is purely infrastructure projects. We believe this is a better alternative to financial aid since project financing can provide a steady stream of cash flows and better ROE when compared to a loan package. Furthermore, it is a win for the receiving countries as well since the investment counts into GDP and does not inflate their debt servicing burden directly.

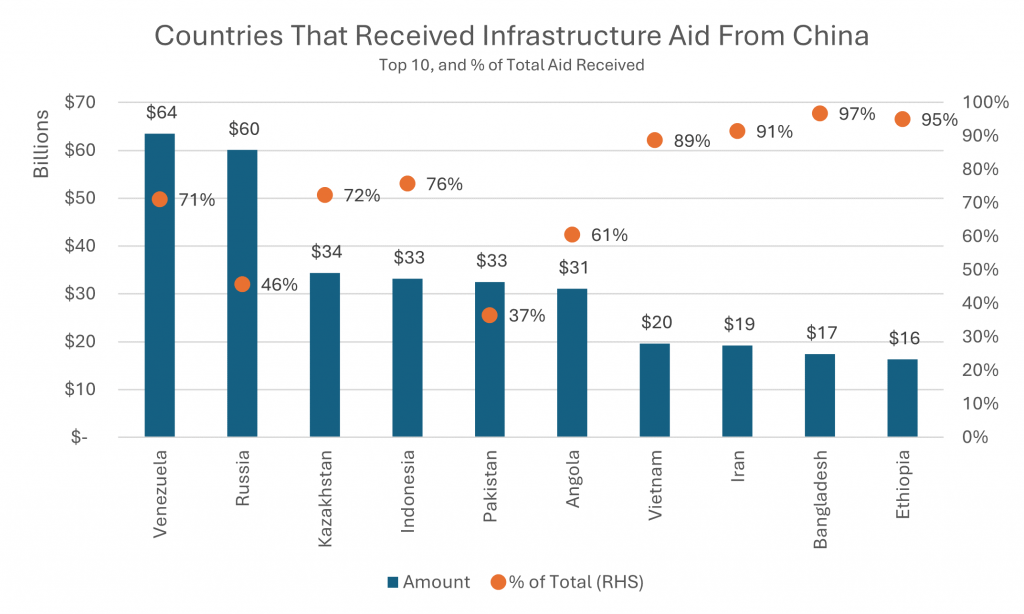

Within the pie of project financing, we note that 69% of the total aid to Africa was in the form of project financing, followed by 63% to the middle east and 62% to Asian economies. Venezuela and Russia were among the highest beneficiary of project financing from China as can be noted in both Exhibit 2 and Exhibit 3.

A trend can be seen in who China offers aid to, or more specifically lends to in this case, their supporters are made up of small countries which have usually suffered from degraded economic conditions.

This allegiance can be further seen in projects spearheaded by China such as the Belt and Road initiative, where most countries that support said projects tend to be Central Asian, African, and South American nations which built relations through accepting aid from China. This puts China in a position where its loyal supporters are mostly made up of much smaller nations.

Exhibit 2:

Source: Aiddata.org

Exhibit 3:

Source: Aiddata.org

The median proportion of project financing to total aid for 140 countries is 76%, this indicates a strong preference towards investment in infrastructure rather than direct funding as a loan. While most of these investments in infrastructure projects are for the development of the receiving country, many of such investments are of strategic importance to China, for example, Hambantota International Port in Sri Lanka has been leased to China for 99 years and the port is used by China to anchor its spying vessels in the Indian Ocean, closed to its strong rival in the region; India.

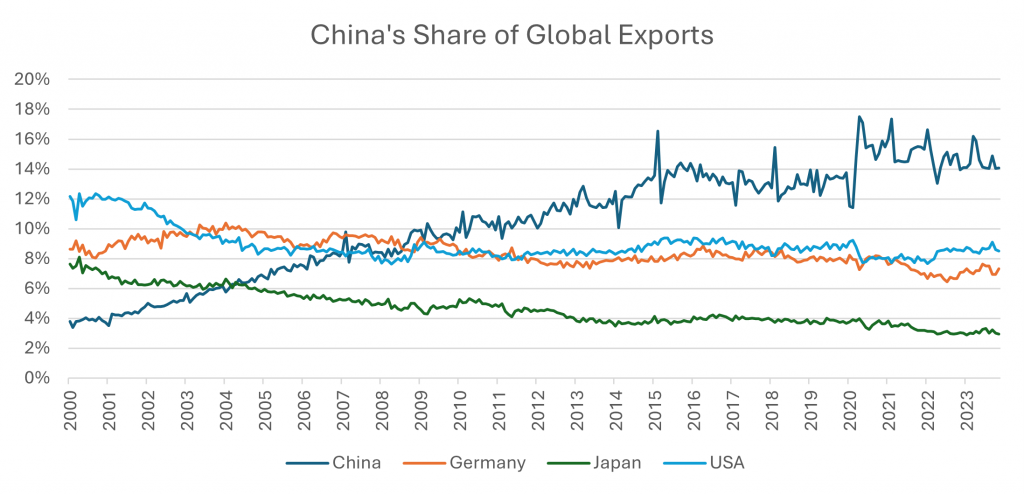

China is an indispensable part of the international trade equation: China is the world’s factory and has remained in an undisputed position since 2010. The share of China to Global exports increased to 14% in 2023 from 3.8% in 2000. The current share of China is almost twice the share of Germany, 1.6x that of the USA and 4.7x that of Japan as can be seen in Exhibit 4.

Exhibit 4:

Source: LSEG Workspace

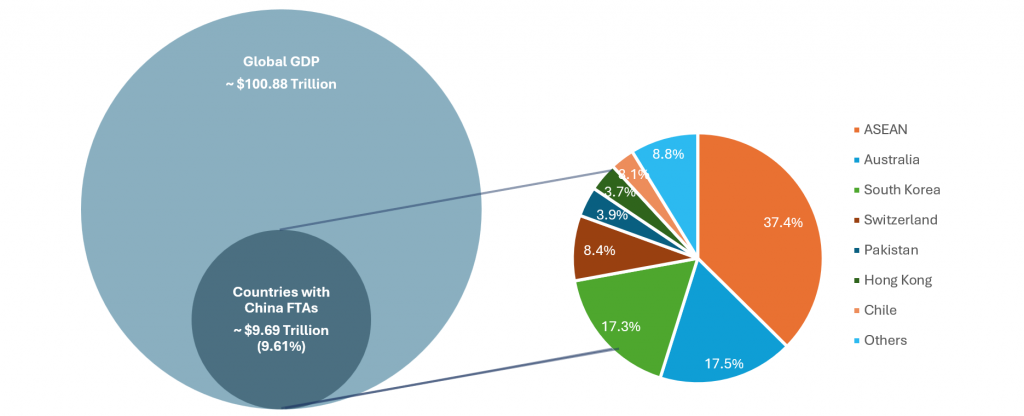

18 countries have free trade agreements with China. These countries constitute 10% of the world GDP and are major trading partners with China. When delving deeper, it can be seen that a big portion of the pie is occupied by Asian countries as well as can be seen in Exhibit 5.

Exhibit 5:

Source: fta.mofcom.gov.cn

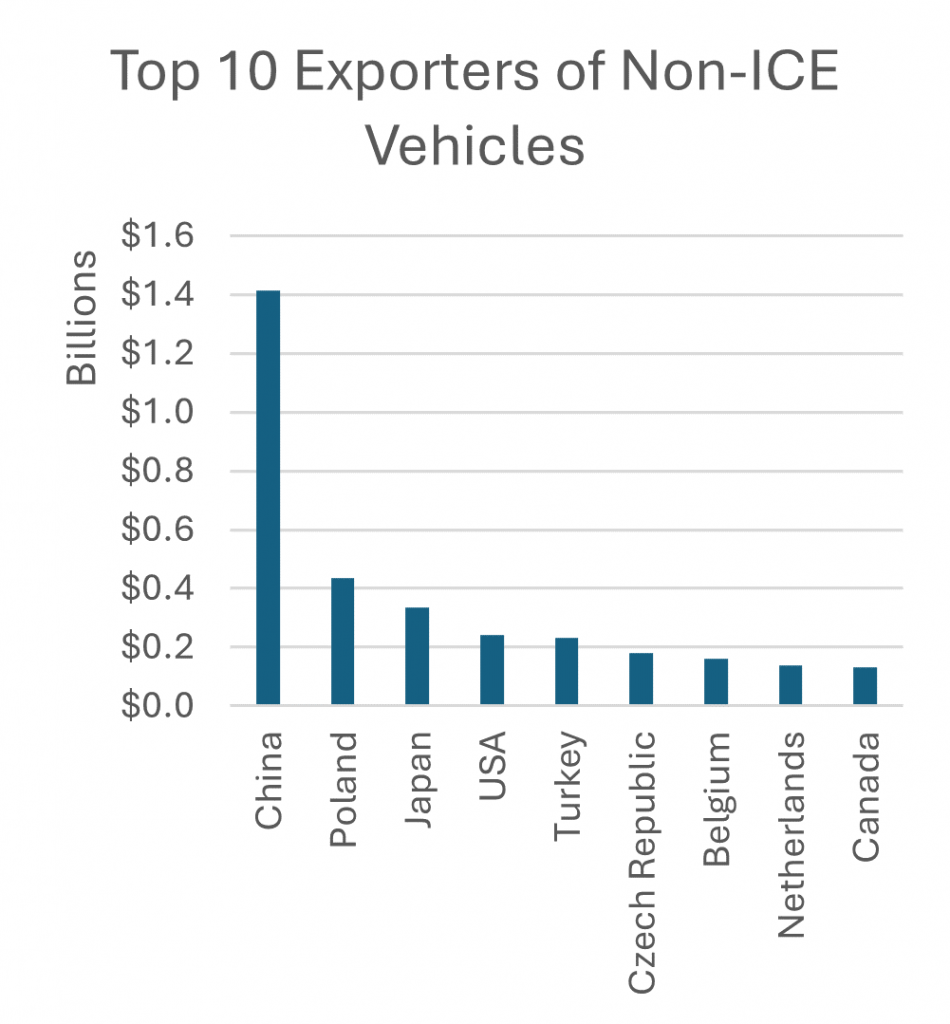

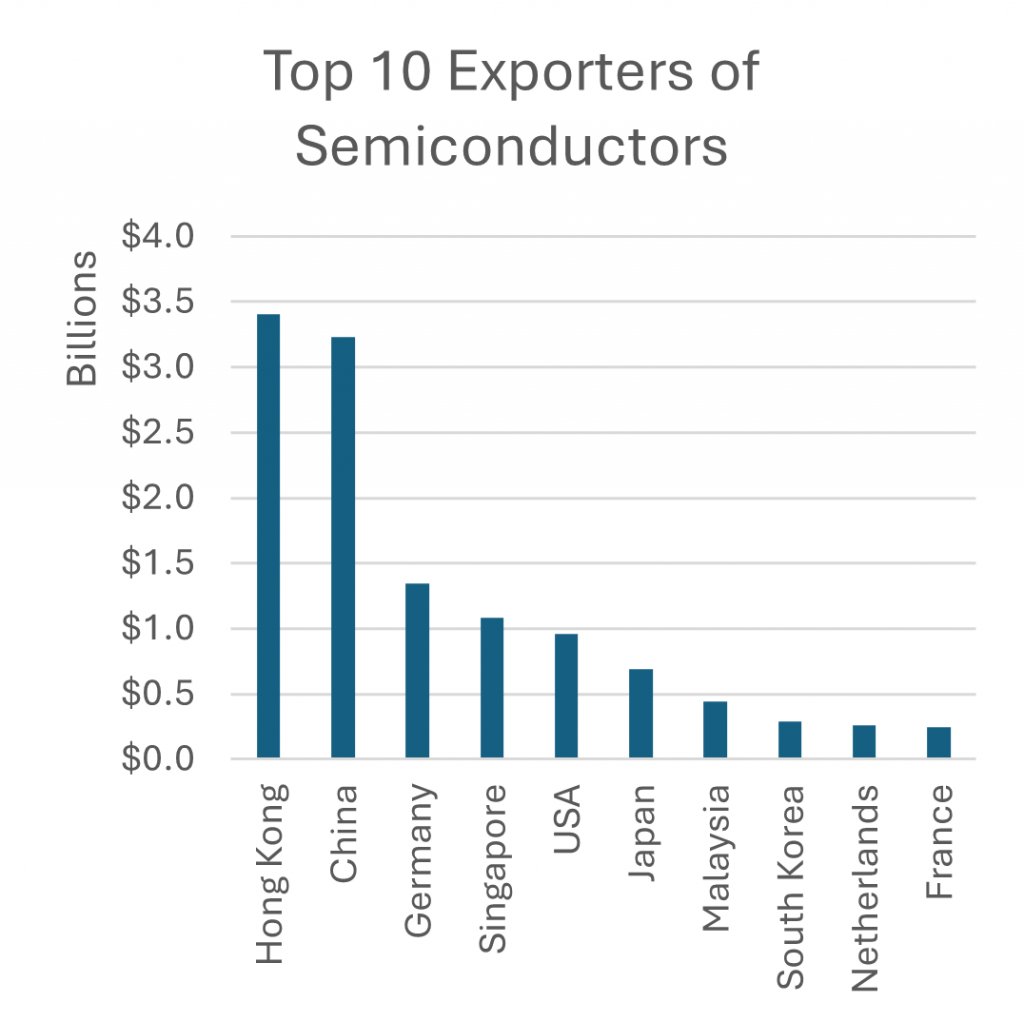

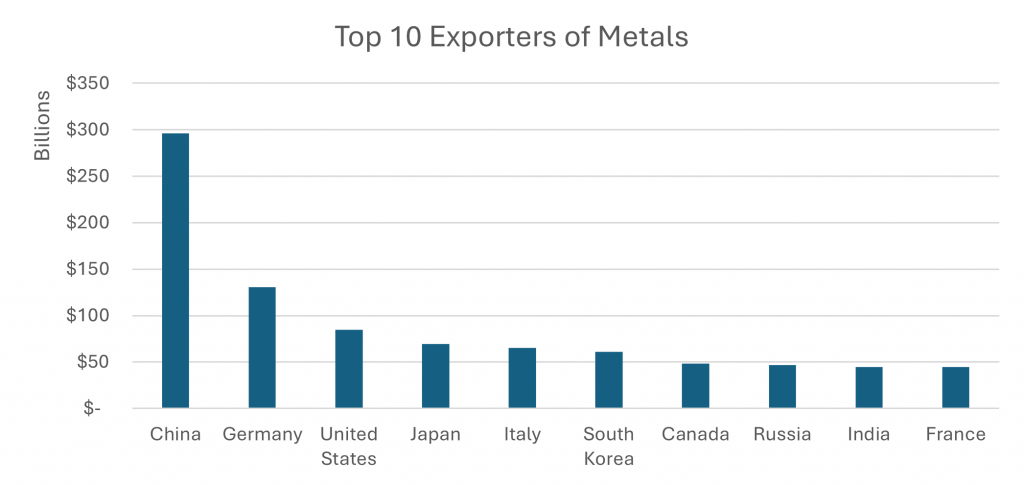

Furthermore, there are some other key sectors where China holds a significant dominance in terms of production, these sectors include but are not limited to Metals, Electric Vehicles, and more importantly, Semiconductors as can be seen in Exhibit 6.

Exhibit 6:

Source: The World Bank

The U.S. government has recently been escalating efforts to limit China’s access to advanced chip technology, recognizing its critical role in both economic competitiveness and national security. This initiative has involved a multifaceted approach, including export controls on semiconductor manufacturing equipment, and restrictions on Chinese investment in U.S. semiconductor companies. However, in contrast to these opposing moves, the U.S. has also historically been the biggest importer of Chinese goods with around $581bn imported in 2022.

This also suggests that trade wars remain limited to certain categories of goods and do not necessarily worsen economic relationships. Similarly, the level of diplomatic relations and trading relationships are largely mutually exclusive sets.

The emergence of a tri-polar world: We believe with China’s global dominance in trade and financial aid along with territorial disputes with many Asian countries and the souring trade relationship with the US, the world is moving towards a tri-polar order. One group with North America and Western Europe led by the US – this is the group that opposes Russia and the dominance of China in their economies. The second group with Russia, China, Eastern Europe, and Africa led by China – this group would consist of all the strong allies of China, or countries significantly indebted to China. Finally, India, the Middle East, and some countries in Southeast Asia with territorial disputes with China – this group would have a neutral standpoint and have allies in both of the other groups. While these could be the broad fronts, the relationships within and with each other can be very complex and multidimensional.

In conclusion, based on China’s position in the world both economically and politically, it would be very complicated for any of the other global superpowers to stand up against China completely because of the significant leverage China exercises over the majority of the world economies.

Contact:

Jinesh Rajpara, CFA

Investment Advisor

jinesh@mef.bh

+973-1711 1703

Yusuf Ahmed

Jr. Investment Analyst

yusuf@mef.bh

+973-1711 1700

Disclaimer: The information on this document should not be construed as legal, investment, financial, professional or any other advice. Content on this document does not represent or constitute any solicitation, inducement, recommendation, endorsement or offer by M E & F Holdings W.L.L. or any third-party service provider to buy or sell securities, commodities, digital assets, or any financial instruments. Nothing on the document constitutes professional and/or financial advice. The views expressed on this document are only of the author(s) and does not necessarily reflect the opinion of any other third party.