As the semiconductor industry continues to drive innovation across various sectors, it faces a complex web of challenges highlighting the need for an understanding of key factors shaping the industry’s future. These chips are the foundation of modern technology and crucial for emerging technologies such as Artificial Intelligence, 5G networks, and the Internet of Things. We have found that the semiconductor industry cannot afford to be restricted in its supply chain and talent pipeline, mainly driven by glaring geopolitical tensions, as growth may necessitate addressing the current global market conditions.

It is worth emphasizing that the semiconductor industry has maintained significant progress across the board, especially in terms of production and supply chain but despite this development, the industry is susceptible to possible bottlenecks that will be delved deeper into throughout the following sections.

Geopolitical Risks:

The CHIPS and Science Act which aimed to prohibit funding recipients from expanding semiconductor manufacturing in China was enacted in 2022 as a tactic deployed by the US government to reiterate their stance on further strengthening their grip on the semiconductor industry as well as hoarding off major players. In addition to the act, the US has also been imposing sanctions on China by tightening export and import controls on advanced semiconductor chips.

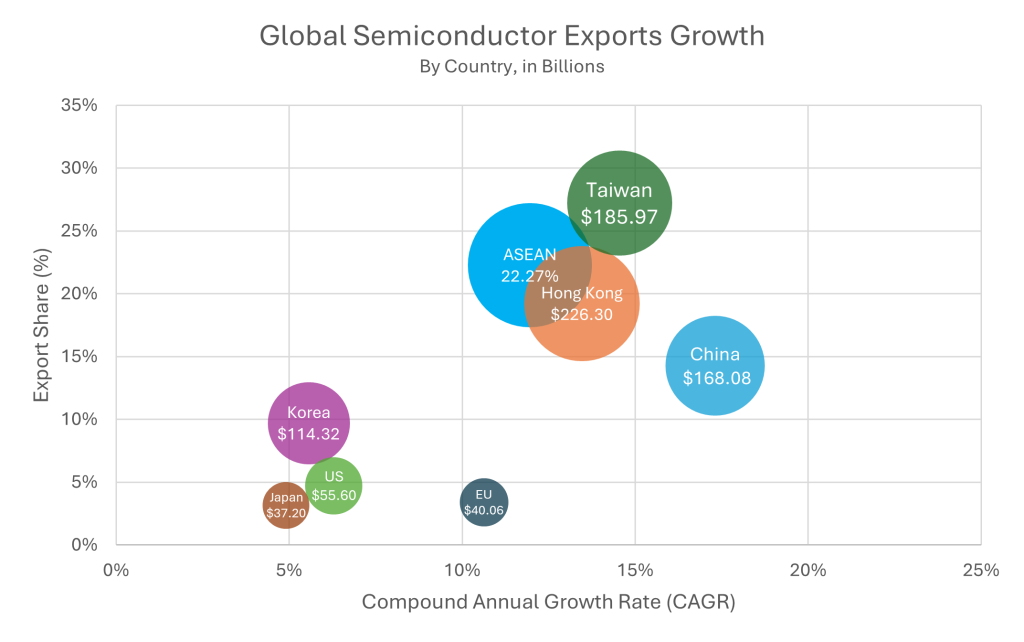

Exhibit 1:

Source: World Bank via World Integrated Trade Solution (WITS)

Exhibit 1 depicts that China, Hong Kong, and Taiwan account for approximately 45% of the export market share with China growing at the fastest rate between 2017 and 2022, and ongoing geopolitical tensions driven by said acts and sanctions may prove to cause major uncertainty amongst companies in the global semiconductor ecosystem. Also, companies operating in the United States such as TSMC, Samsung, and Intel have capitalized on the grant opportunities from the CHIPS act which also means they are prohibited from expanding manufacturing capacity to countries of concern, namely, China, Iran, Russia, and Saudi Arabia. The increasing geopolitical fragmentation within the industry will leave different regions relying on their own suppliers hindering global expansion while possibly eroding the cost efficiencies of globalization.

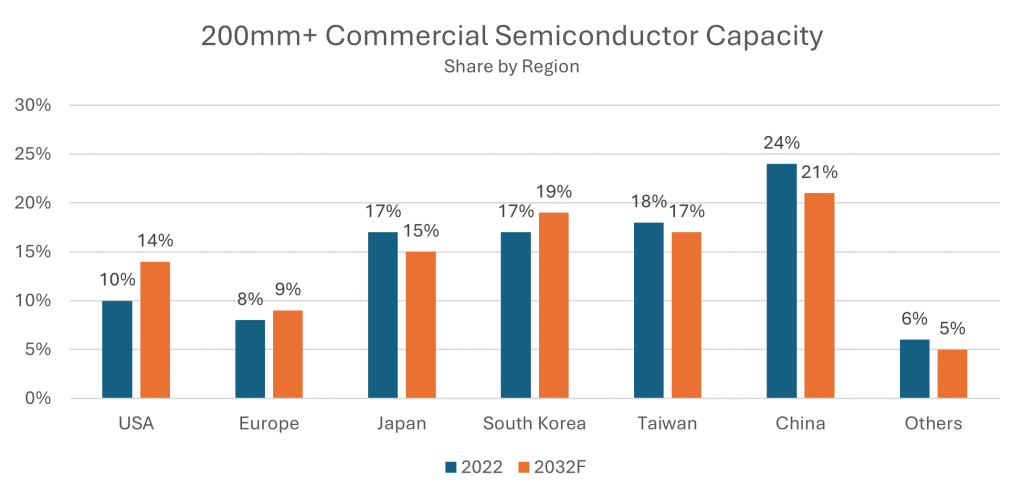

Exhibit 2:

Source: Boston Consulting Group (BCG), Semiconductor Industry Association (SIA)

The 200mm+ fabrication process is pivotal in semiconductor manufacturing due to its use in a wide range of products across the automotive, industrial, and consumer electronics sectors and it being the optimal size ensuring reduced processing complexity and economic efficiency. Exhibit 2 illustrates that despite the USA’s forecasted growth in 200mm+ fabrication capacity from 2022 to 2032, China’s capacity for semiconductors will still be substantial and significantly ahead of said peers. We believe their current fabrication capacity should not be overlooked since prominent companies in the semiconductor industry either outsource some or all of their manufacturing as well as sell their chips to China. Furthermore, the USA is doubling down on the CHIPS Act with the Biden administration trying to close remaining loopholes by encouraging Japan and the Netherlands to follow suit in pricing out such a major global exporter and importer of advanced semiconductor chips and equipment in China.

Supply Chain Bottlenecks:

Several countries have followed an independent approach by significantly investing in their semiconductor industries to boost self-sufficiency and economic security. China, through its “Made in China 2025” initiative and support for SMIC, aims to become a global leader in semiconductors by investing through subsidies, R&D, and infrastructure. As mentioned earlier, the USA, with its CHIPS and Science Act, is providing over $52 billion in subsidies, and companies like Intel are expanding domestic production. The European Union’s European Chips Act plans to double its global market share with €43 billion in investments, while South Korea’s K-Semiconductor Belt aims for a $450 billion investment by 2030. Japan is collaborating with TSMC to build a new fab, and India is attracting global manufacturers through its $10 billion PLI (Performance Linked Incentive) scheme and projects like the Vedanta-Foxconn joint venture.

It is believed that the COVID-19 pandemic also played its part as a driver behind the local investments in R&D, subsidies, and factory infrastructure by said countries as the global semiconductor shortage at the time was driven by a sharp rise in demand for consumer electronics and automotive. There was heightened awareness among countries regarding vulnerabilities in the global supply chain with factories in China, Taiwan, and South Korea shutting down while major companies like TSMC and Samsung faced constrained capacity production because of the accelerating demand. With multiple countries building their own fabrication factories and investing domestically, it raises concerns about the return on investment due to the substantial investment outlay and operating costs. The semiconductor industry’s interconnected supply chain, vital for sourcing raw materials, manufacturing equipment, and testing services, cannot sustain fragmentation due to its global network of suppliers.

Another crucial aspect to consider that poses a threat to the global semiconductor supply chain is the risk of a potential invasion of China or Taiwan as early as 2027, according to the Pentagon. This island, considered a breakaway province by China, is home to TSMC, the world leader in advanced chip production, supplying 90% globally. A disruption in Taiwan’s chip production would have a devastating impact on the global supply chain leading to crippling shortages, logistical nightmares, and staggering price hikes.

Talent Pipeline Shortages:

Lastly, a looming talent shortage threatens the semiconductor industry’s future. Without enough engineers, researchers, and skilled workers, innovation could stall, production could slow, and the industry might lose its competitive edge. Investing in STEM education, upskilling initiatives, and attracting global talent are crucial to keep the chips flowing and fuel future advancements.

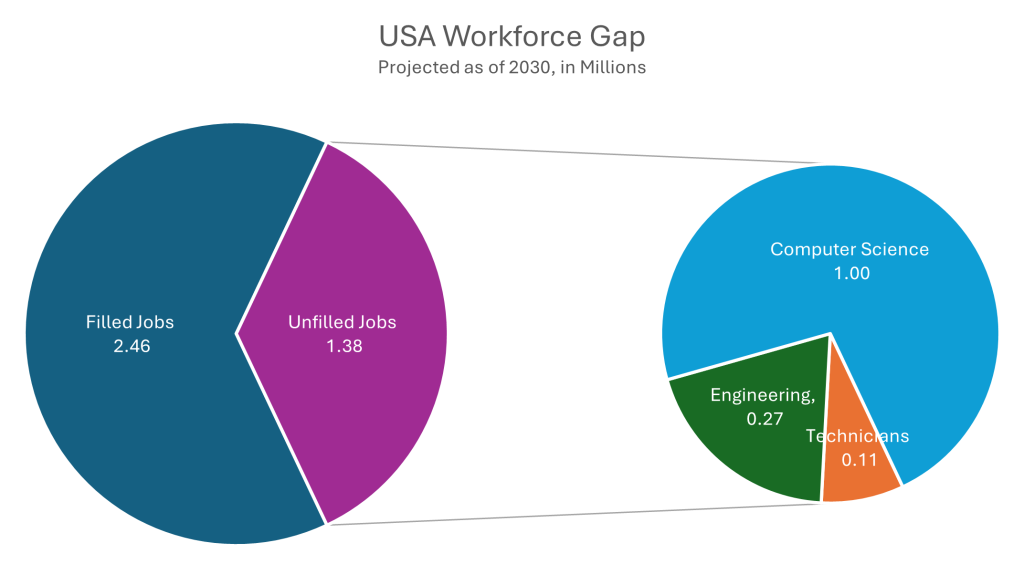

Exhibit 3:

Source: Semiconductor Industry Association (SIA)

For example, ensuring a competitive edge in the semiconductor industry for the USA demands immediate attention to the expected workforce gap outlined in Exhibit 3. The projections indicate a shortage of 1.38 million skilled workers by 2030, particularly in computer science, engineering, and technician roles. To maintain competitiveness across manufacturing, chip design, innovation, and technological leadership, the USA must start strengthening education and training programs at all levels, developing closer ties between STEM education and the industry, implementing reskilling and upskilling initiatives where needed, and reviewing immigration policies to attract and retain global talent.

The future of the semiconductor industry hinges on its ability to navigate these challenges. While the CHIPS Act offers hope for domestic production in the USA and its allies, escalating geopolitical tensions, the threat of conflict in Taiwan, and talent pipeline shortages weigh heavily on the industry. This could lead to regionalized production, hindering global collaboration and innovation, while also potentially causing devastating shortages and price hikes. To ensure a stable future, international cooperation is vital which includes working towards a diversified supply chain, continued investment in research & development, and most importantly, peaceful resolutions to geopolitical tensions.

Contact:

Mohamed Ali

Jr. Investment Analyst

mohamed.ali@mef.bh

+973-1711 1700

Yusuf Ahmed

Jr. Investment Analyst

yusuf@mef.bh

+973-1711 1700

Disclaimer: The information on this document should not be construed as legal, investment, financial, professional or any other advice. Content on this document does not represent or constitute any solicitation, inducement, recommendation, endorsement or offer by M E & F Holdings W.L.L. or any third-party service provider to buy or sell securities, commodities, digital assets, or any financial instruments. Nothing on the document constitutes professional and/or financial advice. The views expressed on this document are only of the author(s) and does not necessarily reflect the opinion of any other third party.