Deglobalization is defined as the process in which nations move against international economic integration, reversing trends seen during the last half-century. While globalization has fostered unprecedented economic growth and interdependence, recent geopolitical, technological, and economic shifts suggest a potential pivot towards deglobalization.

The impacts of this trend show how these policies affect economies and their ties to each other, with a multi-polar world emerging from the unraveling of their interdependence. The resulting economic conditions can result in higher prices, despaired labor markets, and lagging innovation if managed improperly.

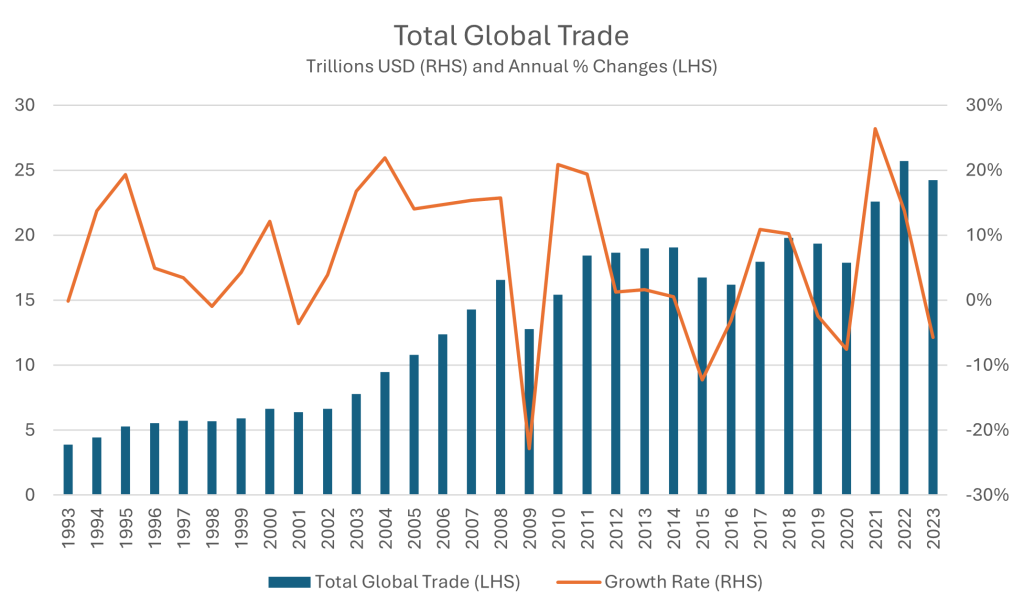

Exhibit 1:

Source: World Trade Organization

Exhibit 1 depicts total global trade from 1993 to 2023. The data shows a slowing growth rate in global trade since the mid-2010s, culminating in significant contractions during the global financial crisis and the COVID-19 pandemic. Furthermore, world merchandise trade volume grew by only 27.7% from 2013 to 2023, compared to 99.5% from 1993 to 2003 and 144.2% from 2003 to 2013. Even when significant contractions are excluded, the growth rate for global trade has been on a decline for the last 10 years, thus indicating a potential decline in globalization and interdependency between trading nations.

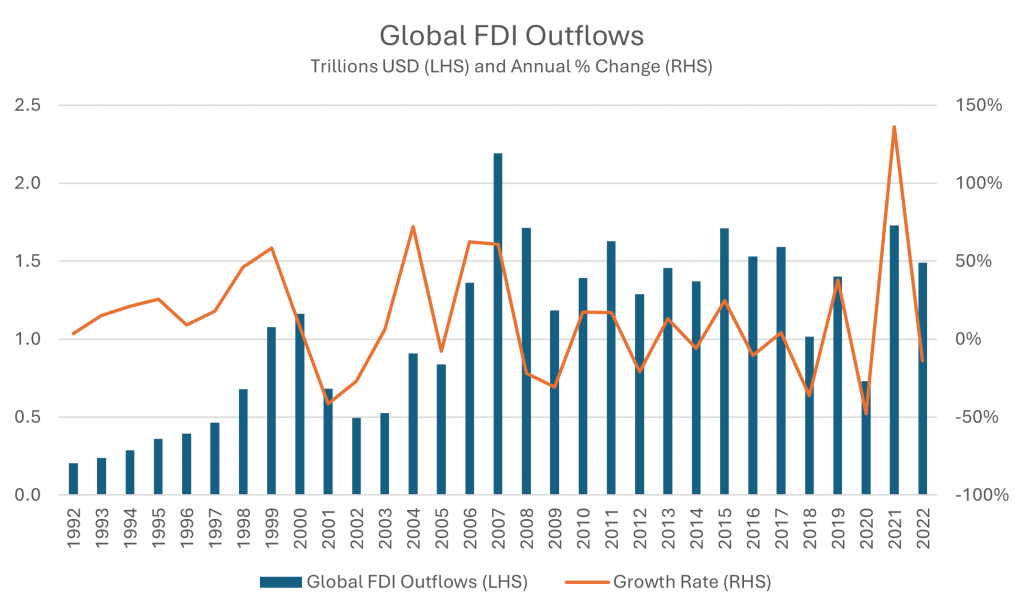

Exhibit 2:

Source: United Nations Conference on Trade and Development

Exhibit 2, which represents total global FDI outflows from 1992 to 2022, shows a general downward trend in the last 10 years or so, with global FDI outflows growing only 15.7% from 2012 to 2022 in comparison to 141.0% and 159.6% from 1992 to 2002 and 2002 to 2012 respectively. Lower foreign investments further support the deglobalization thesis, with nations avoiding overseas investments and preferring to strengthen their local industries.

With nations striving towards more independent economies, several immediate effects have come from their deglobalization. Supply chains, for example, have been experiencing a significant impact from these policies, with more companies re-evaluating their supply chain strategies, emphasizing diversification and regionalization, to enhance supply chain agility and reduce the risk of future disruptions by balancing cost efficiency with resilience.

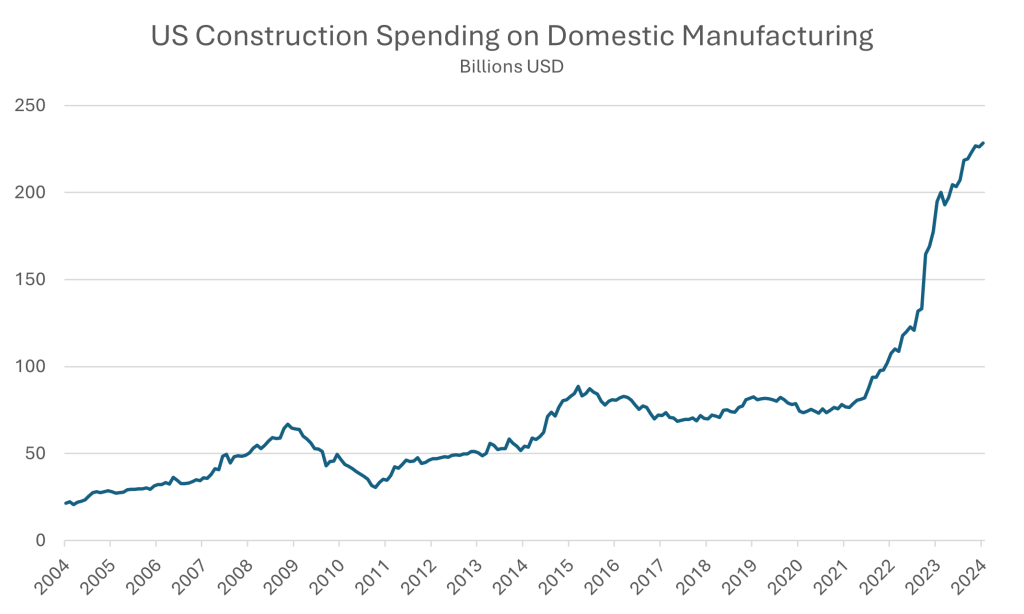

Exhibit 3:

Source: U.S. Census Bureau

Exhibit 3 shows total construction spending on domestic manufacturing within the United States, one of the major poles of the world. Spending has drastically increased within the last few years post the COVID-19 pandemic, with the change in spending from 2014 to 2024 amounting to a staggering 320.3% increase compared to only 152.5% from 2004 to 2014.

With reshoring firms restructure and source inputs domestically rather than from more efficient nations, production costs could therefore experience an increase that would eventually be reflected in final prices and thus push inflation higher. The COVID-19 pandemic further exacerbated these issues, with supply chain disruptions leading to significant price increases for various goods. The increased reliance on domestic production and reshoring manufacturing processes, which are key components of deglobalization, often result in higher production costs. These costs are subsequently transferred to consumers, contributing to higher inflation rates.

Deglobalization can also profoundly impact labor markets. The integration of global labor markets has been a hallmark of globalization, driving economic growth in developing countries through job creation and skills transfer. However, the shift towards deglobalization and the reshoring of jobs can lead to significant changes in employment patterns, wage structures, and labor mobility.

Exhibit 4:

Source: US. Bureau of Labor Statistics

Exhibit 4 shows manufacturing jobs in the United States, reshoring has contributed to a significant increase from previous years, reaching a peak of almost 1 million job openings in mid-2022. Growth in openings over the last 10 years amounted to 87.6%, almost 40 times the growth rate of the previous decade of only 2.2%.

While this may boost domestic employment, it also presents challenges such as the need for retraining workers and addressing skills mismatches. Furthermore, developing countries that have benefited from outsourcing may face economic hardships, as reduced foreign investment could lead to job losses and slower economic growth in these regions.

The trajectory of technological innovation can also be influenced by deglobalization. Historically, globalization has facilitated the rapid spread of technology and innovation through international collaboration, knowledge transfer, and competitive markets. Deglobalization could alter this dynamic, affecting the pace and direction of technological advancements.

Protectionist policies and trade barriers can limit access to cutting-edge technologies and slow the diffusion of innovation. For example, the US CHIPS Act and its policy against China has not only impacted trade but also collaboration between both nations’ technology sectors. Restrictions on technology transfers and the blacklisting of firms like Huawei in the US or Apple in China have disrupted global tech ecosystems, potentially leading to a bifurcation of technology standards and systems.

In conclusion, the trend toward deglobalization poses complex challenges and potential economic disruptions. The reconfiguration of supply chains, shifts in labor markets, and changes in the landscape of technological innovation underscore the nature of this economic shift. While some argue that a move towards more localized economies can enhance resilience and self-sufficiency, the loss of efficiency and growth opportunities cannot be overlooked.

Looking forward, policymakers worldwide will face the delicate task of balancing national interests with the benefits of global economic integration. Striking this balance will be crucial to navigating the evolving landscape, ensuring sustainable economic growth, and maintaining global stability in an increasingly deglobalizing world.

Contact:

Yusuf Ahmed

Jr. Investment Analyst

yusuf@mef.bh

+973-1711 1700

Mohamed Ali

Jr. Investment Analyst

mohamed.ali@mef.bh

+973-1711 1700

Disclaimer: The information on this document should not be construed as legal, investment, financial, professional or any other advice. Content on this document does not represent or constitute any solicitation, inducement, recommendation, endorsement or offer by M E & F Holdings W.L.L. or any third-party service provider to buy or sell securities, commodities, digital assets, or any financial instruments. Nothing on the document constitutes professional and/or financial advice. The views expressed on this document are only of the author(s) and does not necessarily reflect the opinion of any other third party.