An Evolving Opportunity Set

In an increasingly interconnected world, the digital landscape is evolving at an unprecedented pace making robust cybersecurity more important than ever. With the growth in data generation, driven by the widespread adoption of artificial intelligence (AI) and machine learning (ML), new opportunities and challenges are emerging. One of the most critical challenges is the surge in cybercrime, as cyber criminals have devised sophisticated methods to exploit vulnerabilities in our digital infrastructure.

This growing threat has created a substantial demand for advanced cybersecurity solutions, presenting a unique opportunity for companies and investors alike. Investors are also capitalizing on this trend by funding innovative cybersecurity startups and established firms, recognizing the critical need for sophisticated defenses against cyber threats.

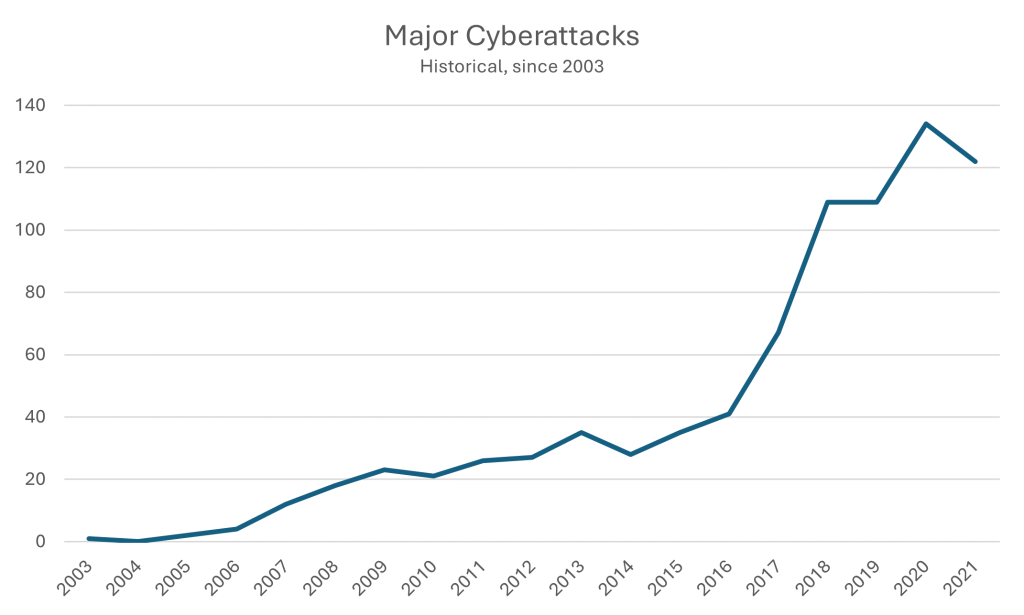

Exhibit 1:

Source: Morgan Stanley Wealth Management

Exhibit 1 shows that the number of significant cyberattacks has increased from only 4 major incidents in 2006 to 120 in 2021. The financial sector stands as a prime target in the cybercrime landscape and as cybercriminals develop new tactics and exploit vulnerabilities, financial institutions must constantly adapt their security infrastructure to stay ahead of the evolving threat. Traditional phishing scams persist, but new threats like ransomware attacks are forcing businesses to shut down, pay ransoms, and face reputational damage, impacting investor confidence. The weakness of the cybersecurity infrastructure has affected the financial system as revealed by the SolarWinds supply chain attack back in 2020, which disrupted trading. Attackers gained access to networks of various organizations including US government agencies and Fortune 500 companies. Royal Mail’s ransomware attack in 2023 disrupted its international mail services where hackers sought $80 million and the attack affected 11,500 branches.

Geopolitical tensions further compound the risk, with increased cyberattacks targeting financial institutions in countries like Russia and Ukraine, potentially manipulating markets and causing investor uncertainty. The potential use of AI in cybercrime adds another layer of concern, as it could automate and personalize attacks, leading to even greater financial losses. To mitigate these risks, financial institutions need robust cybersecurity measures, and investors must consider the company’s innovation initiatives before investing.

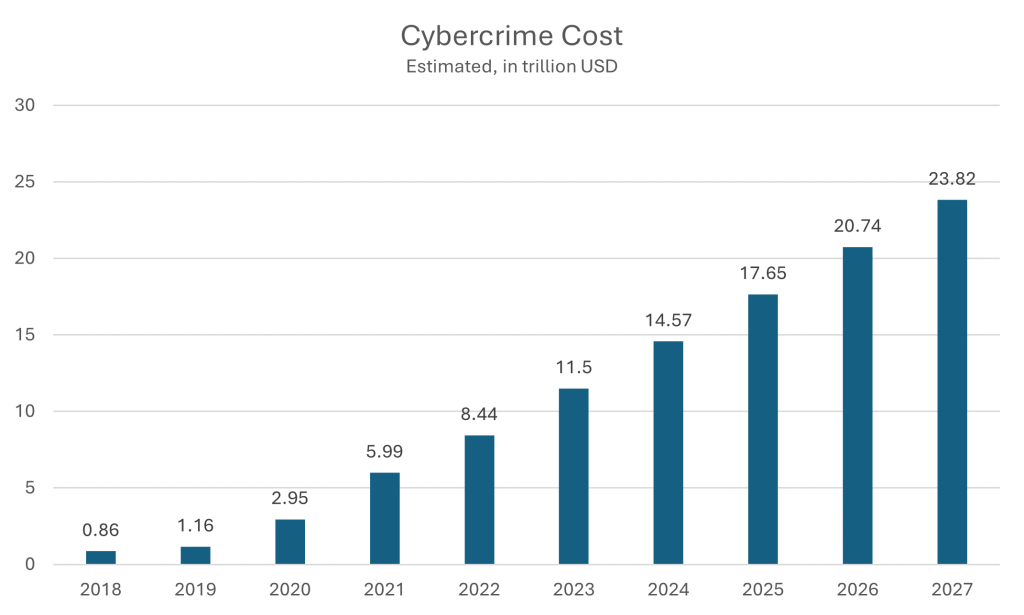

Exhibit 2:

Source: World Economic Forum

As depicted in Exhibit 2, the cost of cybercrime is increasing, with global expenditures expected to reach $17.65 trillion annually by 2025, a steep increase from $0.86 trillion in 2018. This surge is driven by the expanding attack surface as digital transformation accelerates, coupled with the increasing sophistication of cybercriminals. Companies face not only direct financial losses but also substantial indirect costs, including reputational damage, loss of customer trust, and regulatory fines. The financial burden extends beyond businesses, impacting national economies and requiring significant investment in cybersecurity measures.

One of the most notable examples causing a significant loss in wealth is the 2017 Equifax data breach, which exposed the personal information of 147 million people, resulting in an estimated $1.4 billion in total costs for the company, including settlements and security improvements. Another significant incident was the WannaCry ransomware attack in 2017, which affected over 200,000 computers across 150 countries, causing an estimated $4 billion in losses due to business disruptions and recovery expenses. These examples outline the severe financial implications of cybercrime on both corporations and the broader economy.

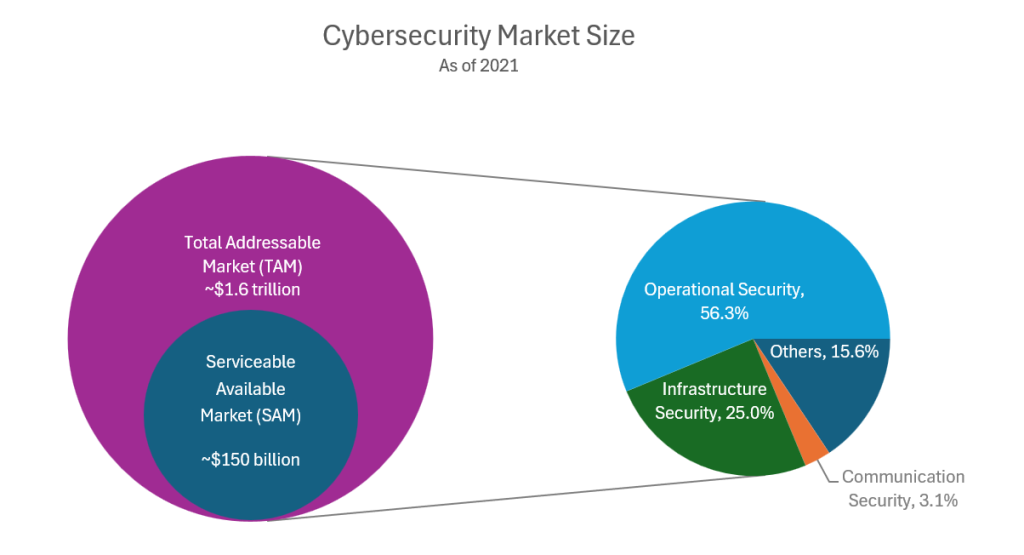

Exhibit 3:

Source: McKinsey & Company, ME&F Analysis

Exhibit 3 highlights a $1.6 trillion market opportunity in cybersecurity, driven by a significant gap between the $150 billion vended market and the total addressable market. Companies that have faced cybersecurity issues can invest in innovative cybersecurity firms to bridge this gap, enhancing their protection in an era where data is crucial for AI and ML. By investing in automation, AI, cloud technologies, and managed services, these companies can not only secure themselves but also drive growth in the cybersecurity sector, addressing the broader market needs accordingly.

The cybersecurity investment landscape is poised to thrive, with venture capital and private equity firms currently focusing on innovative companies driving significant advancements in the field. Notable examples include CrowdStrike, which specializes in endpoint protection and has successfully transitioned to a publicly traded company. Alphabet, which is trying to bolster its cybersecurity portfolio, is in advanced talks to acquire the world’s largest cybersecurity unicorn that utilizes machine learning for automated threat prevention, Wiz. Snyk, known for developer-first security solutions, has raised significant funds and reached unicorn status as well. Auth0, an identity and access management platform, was acquired by Okta for $6.5 billion, underscoring its value and growth potential. These companies exemplify the dynamic nature of cybersecurity investments, attracting substantial funding and driving innovation to meet the challenges posed by cyber threats.

The rapid evolution of cyber threats requires a proactive approach from investors, focusing on companies that innovate in cybersecurity technologies. Investments should prioritize firms leveraging AI, machine learning, and automation to enhance threat detection and response capabilities. Additionally, companies offering comprehensive solutions in endpoint protection, identity management, and cloud security are poised for growth. Given the expanding attack surface and increasing regulatory scrutiny, investing in firms that prioritize robust compliance frameworks is crucial. Moreover, partnerships and mergers in the cybersecurity space can enhance market positioning and technological capabilities, offering potential synergies.

In summary, the cybersecurity landscape presents both challenges and significant opportunities for both investors and companies. As digital transformation accelerates and cyber threats become more prominent, we believe the demand for advanced cybersecurity solutions will continue to grow. The cybersecurity industry stands at the inflection point amidst the rising dominance of AI and cloud computing and we strongly believe that cybersecurity will become an indispensable part of the complete AI chain. Considering the huge TAM for cybersecurity, which is growing every year, we believe Investors can benefit from exposure to both public as well as private market opportunities.

Contact:

Mohamed Ali

Jr. Investment Analyst

mohamed.ali@mef.bh

+973-1711 1700

Yusuf Ahmed

Jr. Investment Analyst

yusuf@mef.bh

+973-1711 1700

Disclaimer: The information in this document should not be construed as legal, investment, financial, professional, or any other advice. Content on this document does not represent or constitute any solicitation, inducement, recommendation, endorsement, or offer by M E & F Holdings W.L.L. or any third-party service provider to buy or sell securities, commodities, digital assets, or any financial instruments. Nothing on the document constitutes professional and/or financial advice. The views expressed in this document are only of the author(s) and do not necessarily reflect the opinion of any other third party.