Automakers worldwide have been intensifying their efforts to electrify their vehicle lineups, driven by a combination of regulatory pressure, market demand, and environmental concerns. However, despite ambitious goals, many manufacturers have been pushing back their timelines for achieving their electrification goals, and consumers have further shown slowing interest in the electric cars. On the automaker’s end, regulatory pressures and short deadlines have made it difficult to electrify the industry, especially with slowing demand on the consumer end due to the higher prices of these vehicles and their underdeveloped infrastructure.

These changes show that the decarbonization of the industry may take longer than expected, thus slowing down investment in the development and support of these vehicles. This can also mean the industry will sustain oil consumption for a longer period of time than earlier envisaged, and thus continue funding the development of conventional vehicles as well.

We can adequately expect margins to be pressured in the auto sector, with manufacturers having already committed the capital expenditures for these costly projects and pushed their timelines further into the future, thus stretching out the period they expect returns on their investments.

Regulatory Pressure to Electrify

Governments worldwide have been enacting regulations to curb greenhouse gas emissions and promote the adoption of zero-emission vehicles. The European Union (EU), for instance, has set an ambitious target for automakers to achieve 100% zero-emission vehicle sales by 2035. Similarly, states like California in the United States have announced plans to ban the sale of new internal combustion engine (ICE) vehicles by 2035, pushing automakers to accelerate their transition to electric vehicles (EV).

These regulatory measures are designed to combat climate change by reducing the automotive sector’s reliance on fossil fuels. They also aim to address air pollution, a significant issue in urban areas. In response, many automakers have pledged to electrify their lineups within the next decade or two.

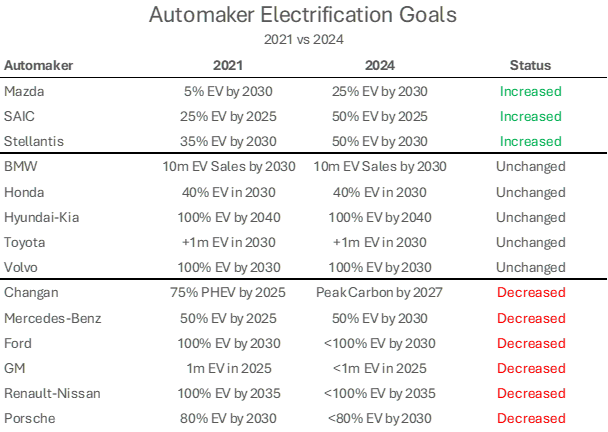

Exhibit 1

Source: International Energy Association, Respective Automakers

However, despite these commitments, several automakers have recently revised their electrification timelines as shown in Exhibit 1, which represents a sample of major automakers and their goals between 2021 and 2024, with a majority of them pushing their goals further into the future. Ford and General Motors, the largest automakers in the US, have pushed their electrification and sales goals respectively, thus continuing the sale and development of ICE vehicles well beyond the deadline set by the EU.

Furthermore, some automakers have set their goals beyond the EU’s target. Toyota, for example, has been slower to commit to a fully electric future. The company now aims for full electrification by 2040, a decade later than many of its competitors. Similarly, Honda has set a target to go all-electric by 2040 and only 40% by 2030.

The delays are not limited to American and Japanese automakers. Mercedes-Benz, which has long been a pioneer in automotive technology, tapered their goals and aims for 50% of their sales to be EVs by 2030, a 5-year push to their previous target, and only 5 years before the EU’s deadline for EV sales. Renault, another major player in the European market, has also expressed skepticism about meeting the 2035 deadline for full electrification, citing the high costs and infrastructure challenges associated with the transition.

Range and Infrastructure Challenges

Another significant barrier to the widespread adoption of EVs is the limited range. Although EV ranges have been improving, they still generally fall short of the distances that can be covered by a full tank of gasoline. This barrier is difficult to balance, as larger batteries provide better range, but their heavier weight sacrifices the benefits as well. This limitation is particularly concerning for consumers in regions with less developed charging infrastructure.

In addition to range anxiety, the current state of charging infrastructure is another factor delaying the transition to EVs. While there has been progress in expanding the network of charging stations, many areas still lack sufficient coverage, making long-distance travel in an EV inconvenient.

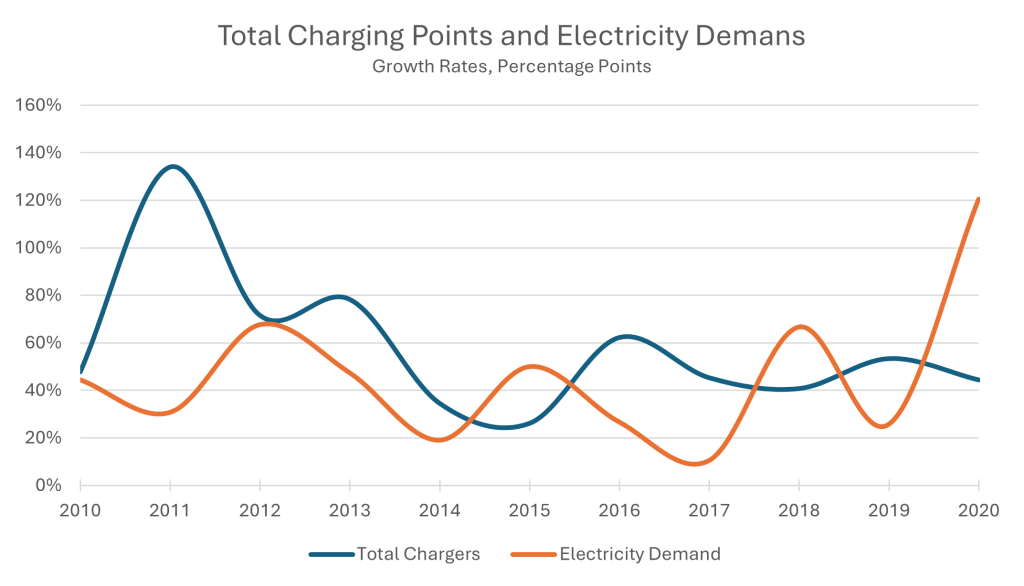

Exhibit 2

Source: International Energy Association, U.S. Department of Transportation

Exhibit 2 illustrates a significant difference in the growth of electricity needs for EVs and the growth of charging stations for said EVs. Assuming a 60KWh battery in the 40m EVs on the road today and all 3.9m charging stations deliver fast charging, the total number of stations should provide approximately 42,000 GWh on average. This figure is slightly below the demand for 2022 which tallied up to 44,000 GWh, but far below the 2023 figure of 97,000 GWh, amounting to an almost 120% increase in electricity needs.

This is seen in consumer sentiment as well, as McKinsey had surveyed over 30,000 EV owners in their Mobility Consumer Pulse report for 2024, and their results showed 29% of global EV owners wanted to switch back to ICE cars, with 35% of them citing charging infrastructure as their main motivator.

Slowing EV Sales and Production

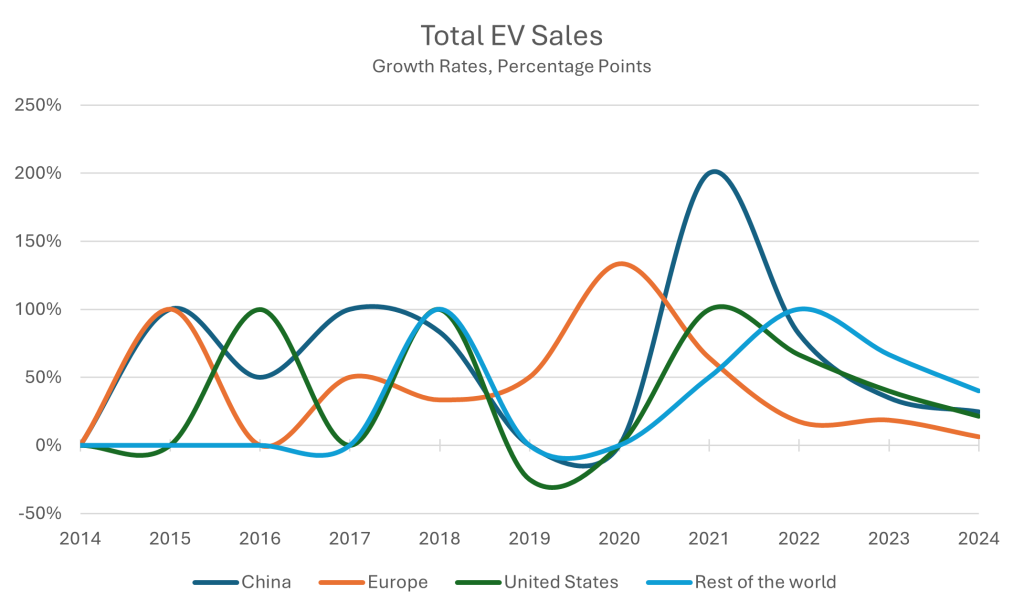

Exhibit 3

Source: International Energy Association, U.S. Department of Transportation

The recent slowdown in EV sales in 2023 and 2024, as shown in Exhibit 3, played a role in automakers’ decisions to delay their electrification targets. After years of rapid growth, the EV market has seen a cooling off in some regions, particularly in China, which has been a key driver of global EV sales. This slowdown is due to various factors, including the phasing out of government subsidies, and consumer concerns about the cost and convenience of owning an EV.

In markets where EV adoption is still in its early stages, sales growth has been slower than expected. This is partly due to the higher upfront costs of EVs compared to traditional vehicles, as well as the aforementioned issues of range and charging infrastructure. As a result, automakers are finding it challenging to justify the aggressive electrification timelines they initially set. This pain point is further highlighted with nations such as the EU and the US aiming to curb EV imports from other nations through the use of tariffs and taxes, such as EVs produced in China, which managed to tackle the pricing problem with EVs by offering highly competitive options in similar segments to their ICE counterparts.

One of the primary reasons automakers are pushing their electrification targets is the high cost of producing these vehicles. EVs require expensive components, particularly batteries, which are costly to manufacture and source. Although battery costs have been decreasing, they still represent a significant portion of an EV’s total production cost.

Moreover, the development of EV-specific platforms, retooling of factories, and investments in research and development for new technologies add to the financial burden. These costs are particularly challenging for automakers with lower profit margins, making it difficult to justify the massive capital expenditure required for a rapid transition to EVs. And with automakers extending their timelines to electrify their product lines, the return on investment on these large capital expenditures is further stretched.

Conclusion

While the transition to electric vehicles is ongoing, the path forward is proving to be more complex and challenging than had been anticipated. Nearing deadlines, limitations in infrastructure, and slowing sales have forced a major push in electrification targets across automakers. Despite regulatory pressure and the growing urgency to address climate change, a lot of these companies are finding it difficult to meet the ambitious timelines they initially set.

As the industry navigates these challenges, it is likely that we will see a slower transition to electric vehicles. This leads us to believe that the next few years will be a transitionary period for automakers as they balance the demands of regulation with the realities of market conditions. Demand will likely remain subdued compressing margins and visibility of healthy ROIs on the EV portfolio.

Contact:

Jinesh Rajpara, CFA

Investment Advisor

jinesh@mef.bh

+973-1711 1703

Yusuf Ahmed

Jr. Investment Analyst

yusuf@mef.bh

+973-1711 1700

Disclaimer: The information on this document should not be construed as legal, investment, financial, professional or any other advice. Content on this document does not represent or constitute any solicitation, inducement, recommendation, endorsement or offer by M E & F Holdings W.L.L. or any third-party service provider to buy or sell securities, commodities, digital assets, or any financial instruments. Nothing on the document constitutes professional and/or financial advice. The views expressed on this document are only of the author(s) and does not necessarily reflect the opinion of any other third party.