The European Union (EU) recently imposed significant tariffs on Chinese electric vehicles (EVs). These tariffs, which range from 17.4% to 37.6% depending on the manufacturer, are a response to what the EU views as unfair competition from heavily subsidized Chinese EVs. The European Commission determined that these subsidies allow Chinese automakers to sell vehicles at much lower prices than European manufacturers, threatening the EU’s domestic EV industry.

These decisions are bound to have sizable effects on the relationship between the EU and China, as retaliatory measures extend beyond the automotive sector. These decisions can also be seen as a way for the EU to reshore the sector and focus on local automakers while decoupling from China, as what has been seen in the Western world across different sectors.

Following up on our last article on how automakers have been pushing EV targets further behind, policies like tariffs may end up inflicting further pain on these plans as automakers revert to reshoring their manufacturing to costlier local regions and as sales exhibit further slowdowns as consumers become priced out of segments, they previously deemed affordable.

Impact on Automakers

For Chinese EV manufacturers, these tariffs pose a significant hurdle to further market expansion in Europe. Additionally, the Chinese government is likely to retaliate, potentially targeting EU exports with similar tariffs, which could escalate into a broader trade conflict.

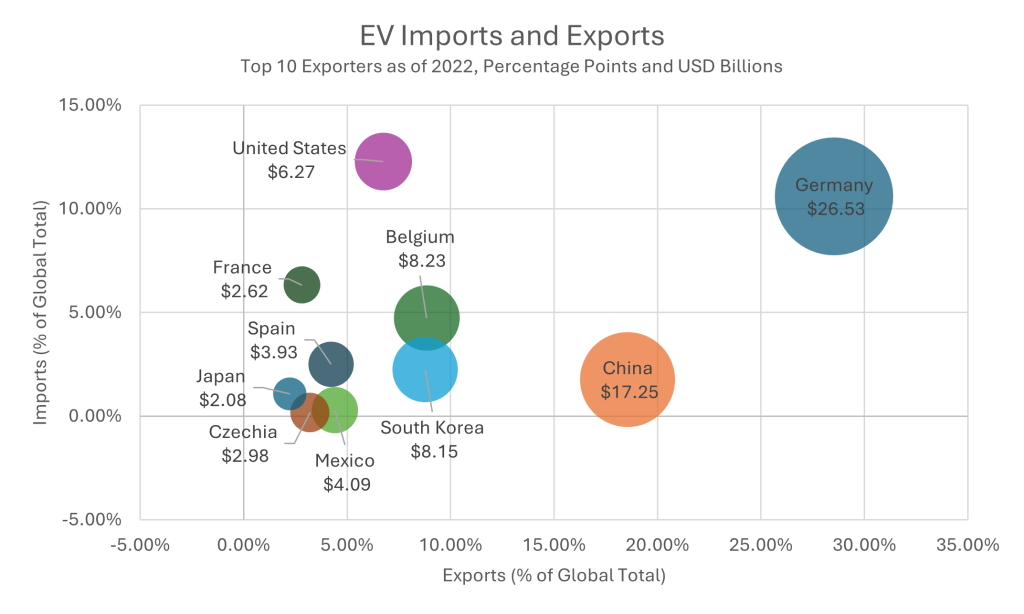

Exhibit 1

Source: International Energy Agency, The Observatory of Economic Complexity

Interestingly, the tariffs also pose risks to European automakers. German car companies such as Volkswagen and BMW, which produce cars in China for export to Europe, could see their business disrupted. Exhibit 1 shows European EVs produced in China alongside their sales figures within the EU, the numbers show EV imports and exports from the top 10 exporters, while China has lower exports in dollar value, they beat Germany in the number of vehicles exported at 4.4 million compared to 470 thousand from Germany, this is due to the difference in the average value of exported vehicles between the nations with China’s average being around $4,300 per vehicle while Germany is at around $77,400 per vehicle. The chart further shows how little China imports in EVs compared to the other nations, this shows China’s position as the largest EV exporter by units and the stakes it faces with the tariffs in place.

European automakers have also argued that the tariffs will also harm joint ventures and partnerships between European and Chinese manufacturers. Such disruptions could lead to losses for European carmakers who rely on China as both a manufacturing hub and a critical market. These changes can overall lead to higher inflation within the EU, primarily coming from automakers returning their manufacturing to Europe which lacks the cheap labor and manufacturing subsidies seen in China, this would also cause EV prices to increase within the region, further adding to the overall goods basket and pressuring already slowing sales within the sector.

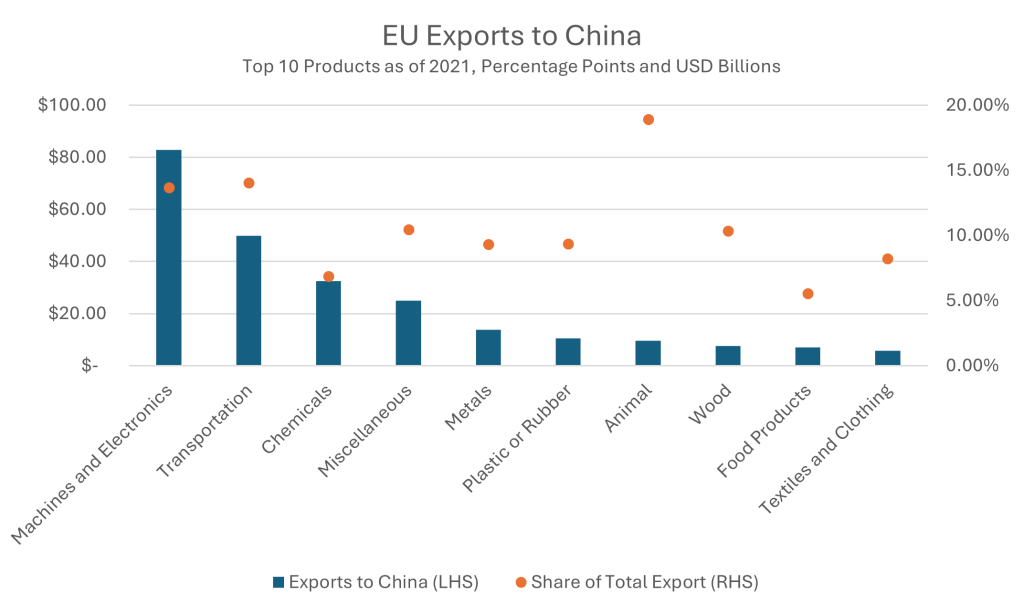

Exhibit 2

Source: World Integrated Trade Solutions

These tariffs also have broader geopolitical implications. On the one hand, they are likely to strain trade relations between the EU and China. China has already voiced its displeasure and could counter these decisions with tariffs of its own on European goods, and thus hurting other industries that rely on exports to China within the EU. Exhibit 2 shows the European Union’s exports to China, their third largest export market making up around 10% of their total export share as of 2021. China is in a position to impose tariffs on exported goods with values far surpassing the total value of EVs exported by China, the nation also makes up over 10% of total exports of half the goods from the EU, raising the stakes for the EU and any of their industries that depend on China.

This decision may even create disparity between members of the EU, as some of the nations have developed stronger trade relations with China than others such as Germany and Italy, and some nations may not be able to afford an increase in prices, further adding to the strain on EV sales in them and their electrification goals.

Conclusion

While the EU’s tariffs on Chinese EVs are designed to protect its domestic industry from subsidized competition, they also carry significant risks. Both European consumers and automakers could face higher costs, while the possibility of Chinese retaliation looms large as trade relations between the regions become stressed.

Going forward, we expect to see a further slowdown in the sales of EVs within the EU, alongside increased pressures on European automakers’ profits as buyers of more affordable vehicles become priced out of the segment. This can also contribute to the EU’s reshoring of manufacturing if automakers wish to revert production to local grounds and decoupling from Chinese manufacturing, which can indirectly push inflation even amidst an economic slowdown.

Contact:

Jinesh Rajpara, CFA

Investment Advisor

jinesh@mef.bh

+973-1711 1703

Yusuf Ahmed

Jr. Investment Analyst

yusuf@mef.bh

+973-1711 1700

Disclaimer: The information on this document should not be construed as legal, investment, financial, professional or any other advice. Content on this document does not represent or constitute any solicitation, inducement, recommendation, endorsement or offer by M E & F Holdings W.L.L. or any third-party service provider to buy or sell securities, commodities, digital assets, or any financial instruments. Nothing on the document constitutes professional and/or financial advice. The views expressed on this document are only of the author(s) and does not necessarily reflect the opinion of any other third party.