The national debt of the United States reached a historic level of $35 trillion as of October 2024, a significant increase from $33 trillion just a year prior. This growth reflects the persistent trend of rising federal debt, driven by a combination of high government spending, tax policies, and economic challenges, including the ongoing impacts of inflation and elevated interest rates.

The rapid expansion of the U.S. national debt is not a recent phenomenon, but rather the result of decades of fiscal policies. Both Democratic and Republican administrations have contributed to this debt, with Joe Biden’s administration alone having added around $8.12 trillion since taking office in 2021, and Donald Trump’s administration also adding approximately $7.74 trillion during its tenure.

Several factors have exacerbated the nation’s debt. Large-scale government programs such as the COVID-19 relief packages, infrastructure investments, and defense spending have all contributed to this mounting figure. These factors all have major implications on the US and its presence as a prime market for investors, lifting credit risk for both public and private sectors and influencing the nation’s monetary and fiscal policy.

Sustainability and Challenges

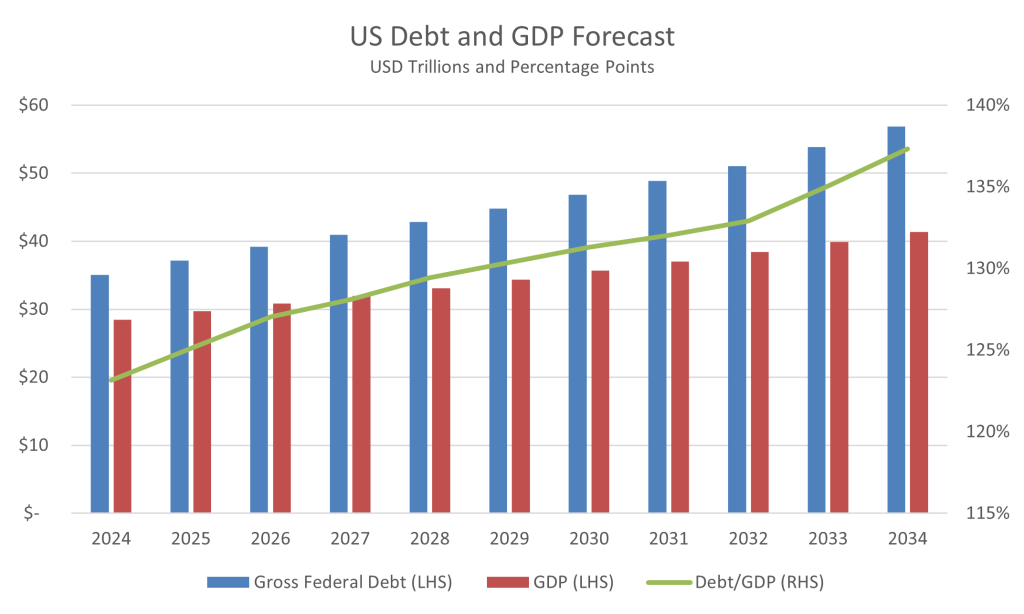

The sustainability of the U.S. debt has become a growing concern for economists and policymakers. Exhibit 1 shows forecasts from the US Congressional Budget Office (CBO) for the next 10 years. The CBO projects US debt to outpace the nation’s GDP growth over the next 10 years, with debt reaching around 137% of the nation’s GDP. A key driver behind this forecast is the increasing burden of interest payments, which are expected to triple over the next 10 years to $1.71 trillion by 2034.

Exhibit 1

Source: Congressional Budget Office

The U.S. government faces the challenge of managing this rising debt while maintaining essential services and programs like Medicare and Social Security. High debt levels could reduce fiscal flexibility and increase vulnerability to economic shocks.

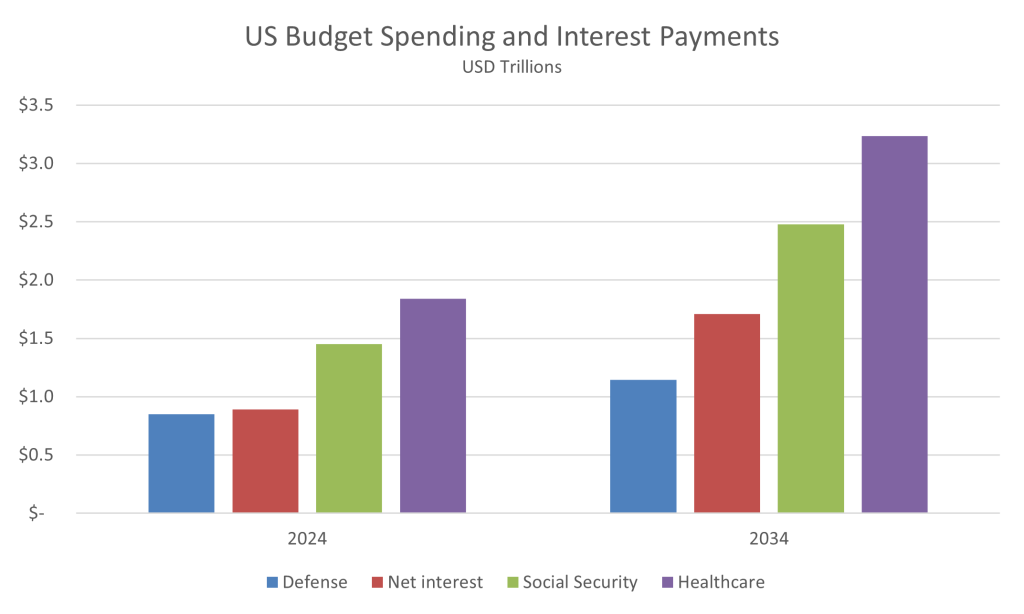

Exhibit 2

Source: Congressional Budget Office

Exhibit 2 shows a comparison between the nation’s mandatory and discretionary expenditures against interest payments, the projections show that the U.S. will face an exacerbated gap between their interest payments and their spending on defense, the largest discretionary expenditure the US spends on. As of today, the US spends 5.2% more on their interest payments than they do on defense, and the CBO forecasts this gap to grow up to 49.5% by 2034.

This can cause interest payments to take up a larger share of federal revenue and crowd out spending on essential programs, making it harder to maintain investments in infrastructure, education, and defense.

The ongoing rise in debt has already led to tangible consequences. In 2023, Fitch Ratings downgraded the U.S. credit rating from AAA to AA+, citing concerns about the nation’s deteriorating fiscal outlook. This downgrade not only reflected the immediate challenges but also signaled future risks to the country’s economic standing.

Conclusion

Going forward, the U.S. must grapple with the dual challenges of high debt and political gridlock. Analysts suggest that without significant reforms to taxation, entitlement programs, and fiscal policy, the national debt will continue to grow at an unsustainable pace. Organizations like the Committee for a Responsible Federal Budget (CRFB) have highlighted that both leading presidential candidates—Kamala Harris and Donald Trump—have proposed fiscal policies that could further increase the debt.

Many experts advocate for reforms to entitlement programs like Social Security and Medicare, which account for a significant portion of federal spending. Additionally, some argue for revisiting tax policies to ensure corporations and high-net-worth individuals contribute more to the nation’s revenue base.

Another approach could involve controlling discretionary spending and implementing stricter budgetary discipline. Historically, bipartisan cooperation has been necessary to address major fiscal challenges. However, the current political environment has made such cooperation more difficult, with both parties favoring policies that add to the deficit.

In conclusion, the U.S. national debt is on an unsustainable path, and addressing this issue will require tough political decisions and comprehensive fiscal reform. Without such actions, the debt burden will likely grow, putting future economic stability at risk.

Conclusion

While the EU’s tariffs on Chinese EVs are designed to protect its domestic industry from subsidized competition, they also carry significant risks. Both European consumers and automakers could face higher costs, while the possibility of Chinese retaliation looms large as trade relations between the regions become stressed.

Going forward, we expect to see a further slowdown in the sales of EVs within the EU, alongside increased pressures on European automakers’ profits as buyers of more affordable vehicles become priced out of the segment. This can also contribute to the EU’s reshoring of manufacturing if automakers wish to revert production to local grounds and decoupling from Chinese manufacturing, which can indirectly push inflation even amidst an economic slowdown.

Contact:

Jinesh Rajpara, CFA

Investment Advisor

jinesh@mef.bh

+973-1711 1703

Yusuf Ahmed

Jr. Investment Analyst

yusuf@mef.bh

+973-1711 1700

Disclaimer: The information on this document should not be construed as legal, investment, financial, professional or any other advice. Content on this document does not represent or constitute any solicitation, inducement, recommendation, endorsement or offer by M E & F Holdings W.L.L. or any third-party service provider to buy or sell securities, commodities, digital assets, or any financial instruments. Nothing on the document constitutes professional and/or financial advice. The views expressed on this document are only of the author(s) and does not necessarily reflect the opinion of any other third party.