The average investor understands the fundamental relationship between investment returns and risks, with the reward earned being proportional to the risk taken by them, high-yield instruments like junk-rated bonds and structured products, such as the Phoenix memory structure, have long attracted the interest of risk seeking investors due to their attractive yields. Under specific conditions, these instruments can match in yields but mismatch in risk, structured products can present a lower risk profile than junk-rated bonds, and the opposite can also be observed in varying market conditions. This article will more specifically explore the risk-reward dynamics of each and consider how structured products can sometimes offer a safer alternative to junk bonds.

Overview of Instruments

A junk-rated bond is issued by a company with a sub-investment-grade rating (below BBB or equivalent). Its “junk” rating reflects a higher probability of default compared to investment-grade bonds. The appealing factor in these bonds is that they can provide attractive returns in favorable economic conditions or if the issuer improves its creditworthiness. Investors in these bonds face potential capital losses if the issuer defaults or if market sentiment turns negative, causing prices to drop.

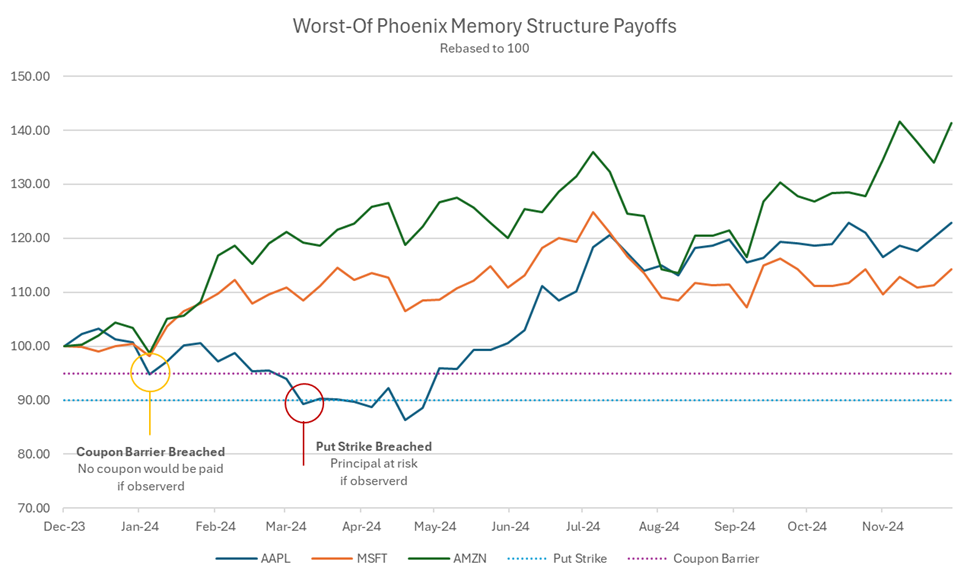

The Phoenix memory structure is a structured product linked to a single or a basket of underlying assets, typically stocks or indices. This instrument provides conditional coupon payments based on the performance of the worst-performing asset in the basket against a put strike and a coupon barrier, performance is observed periodically based on the issued product with quarterly observations being the most common. If the worst-performing asset drops below the coupon barrier level, coupons are halted, and the structure risks principal loss when the asset drops below the put strike. Exhibit 1 shows how payoffs would work in a worst-of Phoenix memory structure on Apple, Microsoft, and Amazon.

Exhibit 1

In this example we have assumed that all the stocks have an initial price (reference price) as USD 100 with a put strike level of 90% and coupon barrier level of 95% and an autocall level of 100%. The coupon on the structure is 13% p.a. with a quarterly observation. This means that if the worst performing stock on the next quarterly observation date is above the coupon barrier level, the coupon is paid. If the said stock is below the coupon barrier level however above the put strike level then no coupon is paid. Alternatively, if the worst performing stock is above the initial level on the quarterly observation, then the product gets autocalled with a coupon paid (13%/4 = 3.25%).

While the structure’s distributions come in the form of a coupon, similar to how bond distributions are made, its performance and pricing are dependent on market performance and the volatility of the underlyings, unlike the fixed payments of a bond.

It must be noted that increasing the underlyings in a Phoenix structure does not equate to an increase in potential coupon payments. Since pricing is usually based on the weighted and risk adjusted average volatility between the underlyings, investors use multiple underlyings as a way to hedge against factors.

Risk Differences

Junk-rated bonds primarily involve credit risk of a single entity, as returns depend on the issuer’s ability to remain solvent and make payments. If the company defaults, bondholders could lose their principal, though they might recover some of it depending on the bond’s seniority. However, this is a highly variable risk, and it is dependent on the issuer’s asset base.

The structure on the other hand faces market risk, specifically tied to the performance of its underlyings. If this asset stays above the coupon barrier level, the structure pays regular coupons. If it falls below, payments are halted until recovery. Though there is credit risk of the underlying basket stocks, if high quality equity names with strong balance sheet are to be selected, the credit risk becomes primarily dependent on the issuing bank.

If structured with high-quality equities, the risk profile of a structure can be less risky than a junk bond over a specified tenure, this is because the equities can offer the potential for growth in earnings and dividends. While earnings and dividend growth does not directly affect the payout of the structure, companies that exhibit these traits tend to have strong balance sheets, stable cash flows, and competitive advantages and are often better equipped to weather economic downturns and adapt to changing conditions than high risk issuers with low credit ratings, providing a degree of resilience.

Coupon Consistency

With junk-rated bonds, investors receive scheduled coupon payments as long as the issuer remains solvent and is able to make payments. This provides a degree of income stability, assuming no credit event occurs. The yield, therefore, is generally more predictable in high-yield bonds, barring extreme financial deterioration in the issuer.

The Phoenix structure’s payments, on the other hand, are conditional, meaning that regular coupon payments hinge on the worst performing asset in the basket staying above a predefined barrier. If this asset dips below the coupon barrier, payments cease until it recovers, causing uncertainty around income. This is where the “memory” feature serves as a hedge as it may allow missed payments to be recouped if assets recover.

There are guaranteed coupon structures too which can be compared loosely with a bond payment which we have elaborated below.

Principal Protection

When it comes to principal recovery,the principal is returned at maturity for bonds, provided the issuer remains solvent. However, if the issuer defaults, unsecured bonds face substantial risks, as they lack specific collateral. While they do rank above subordinated debt, recovery rates can still be low in a bankruptcy scenario.In aPhoenix structure, principal risk centers on the barrier and strike levels, which also influences its pricing. If all assets stay above the put strike, the investor’s principle is secure. Diversifying the underlying assets in the basket can help stabilize performance, reducing the likelihood of a barrier breach. However, this is not to say that the principle in these type of structures is protected but with a low put strike these structures provide a significant downside risk protection which otherwise is not available in a comparable junk bond.

How the Phoenix Structure Can Be Less Risky

Phoenix memory structures rely on the performance of selected underlyings, including assets from different sectors and increasing the number of underlyings can reduce correlation within the structure. If one asset underperforms, the rest can potentially offset the loss, reducing the chance of a barrier breach. This diversification is a benefit not available in a junk bond, which relies on a single issuer’s creditworthiness.

Furthermore, the memory feature offers flexibility in income generation. If market conditions temporarily affect payments, they can still be recouped if the assets recover. This “second chance” at income recovery doesn’t exist with junk bonds, where missed coupon payments often mean permanent loss.

Finally, structured products, especially Phoenix structures, can be more liquid in some markets than junk bonds, which are often traded at discounts in secondary markets. The flexibility to sell a Phoenix structure in certain markets offers investors an exit route, while junk bonds can be difficult to liquidate without taking a significant discount.

Considering a real-world example, Vericast Corp, a US based marketing solutions company, has issued debt maturing in 2027 yielding around 8.17% today (US92342NAK90). The company is rated B- after an upgrade from CCC by S&P Global recently but their recovery estimates remain between 0%-10% for the issue.

Almost the same yield can be achieved with a Phoenix memory structure, with Apple, Microsoft, and Amazon as worst-of underlyings under a 70% put strike and guaranteed coupons. This means that the same yield earned by a junk rated issuer in the US can be earned in a structure with the three largest companies in the US and coupons guaranteed unless an underlying dips below 30% during an observation.

Though this equity structure to bond payoff is counter intuitive it is worth noting that bond inherently is not less risk than equity in such cases and payoffs may be identical but the risk to reward graph is inverted. You are better off holding an equity structure with 30% downside protection with the three largest tech companies in the world than holding a Junk bond with deteriorated credit profile as a single name exposure.

Conclusion

When used strategically, a Phoenix memory structure can offer a lower-risk profile than a junk-rated bond. This structured product, particularly when the assets in its basket are selected to be diversified and are expected to have low volatility, has a more predictable risk profile than a bond that’s entirely dependent on the creditworthiness of a single, high-risk issuer. While high-yield bonds provide a simpler investment with a fixed income stream, they are susceptible to credit events and economic downturns.

For risk-conscious investors seeking yield with a balanced risk profile, a carefully structured Phoenix memory structure may offer safer returns than a junk bond. By leveraging diversification, volatility assumptions, and the memory feature, this structured product can provide a more controlled approach to income generation and capital preservation.

Deconstruction of risk is very important to understand whether adequate reward is offered while comparing returns of two investment prospects.

Contact:

Jinesh Rajpara, CFA

Investment Advisor

jinesh@mef.bh

+973-1711 1703

Yusuf Ahmed

Jr. Investment Analyst

yusuf@mef.bh

+973-1711 1700

Disclaimer: The information on this document should not be construed as legal, investment, financial, professional or any other advice. Content on this document does not represent or constitute any solicitation, inducement, recommendation, endorsement or offer by M E & F Holdings W.L.L. or any third-party service provider to buy or sell securities, commodities, digital assets, or any financial instruments. Nothing on the document constitutes professional and/or financial advice. The views expressed on this document are only of the author(s) and does not necessarily reflect the opinion of any other third party.