The European Union (EU), often considered a bellwether of global economic stability, has been grappling with a discernible slowdown in recent years. From an investment perspective, this deceleration is marked by sluggish GDP growth, uneven corporate valuations, and the ramifications of both internal and external policymaking decisions. With annual GDP growth in the region slipping below 1% in 2023, compared to an average of 1.8% in the preceding decade, the bloc faces mounting questions about its ability to remain a lucrative destination for global capital. This article delves into the underlying factors contributing to the EU’s current economic challenges, with a focus on investment metrics, valuations, and the role of policy decisions in shaping growth trajectories.

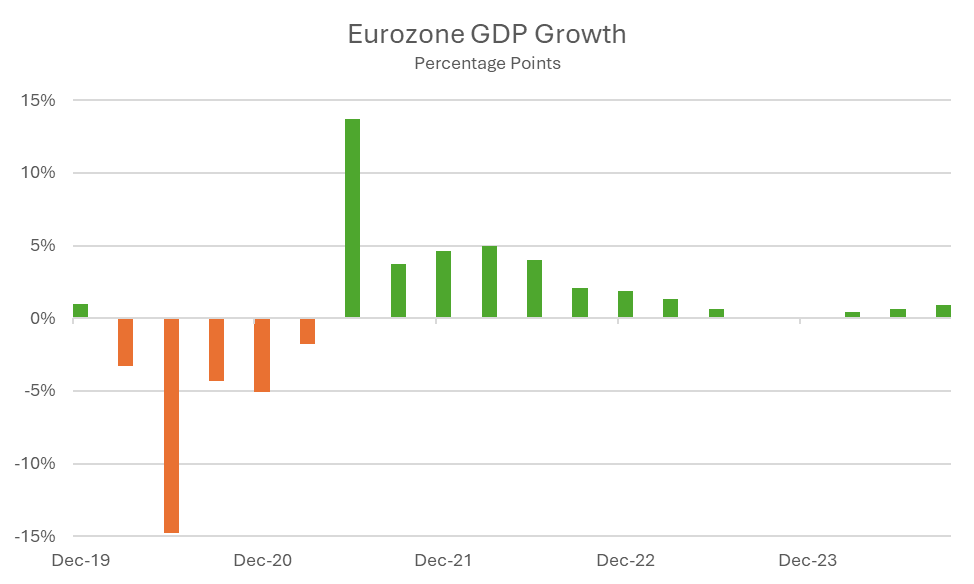

To understand the slowdown, one must first examine the EU’s growth patterns. For much of the past decade, the region experienced moderate but stable expansion, supported by a combination of robust exports, domestic consumption, and accommodative monetary policies from the European Central Bank (ECB). Between 2013 and 2019, the EU’s GDP grew at an average annual rate of 2%, a respectable figure for a mature economic bloc. However, the onset of the COVID-19 pandemic in 2020 disrupted this trend, resulting in a 6.4% contraction that year. Although the region rebounded with 5.4% growth in 2021, the recovery proved short-lived as subsequent years were marred by supply chain disruptions, energy crises stemming from geopolitical tensions, and rising inflation. By 2023, the EU’s GDP growth had dwindled to a meager 0.4% as observed in Exhibit 1, underscoring the challenges of sustaining momentum in a volatile global environment.

Exhibit 1

Source: Eurostat

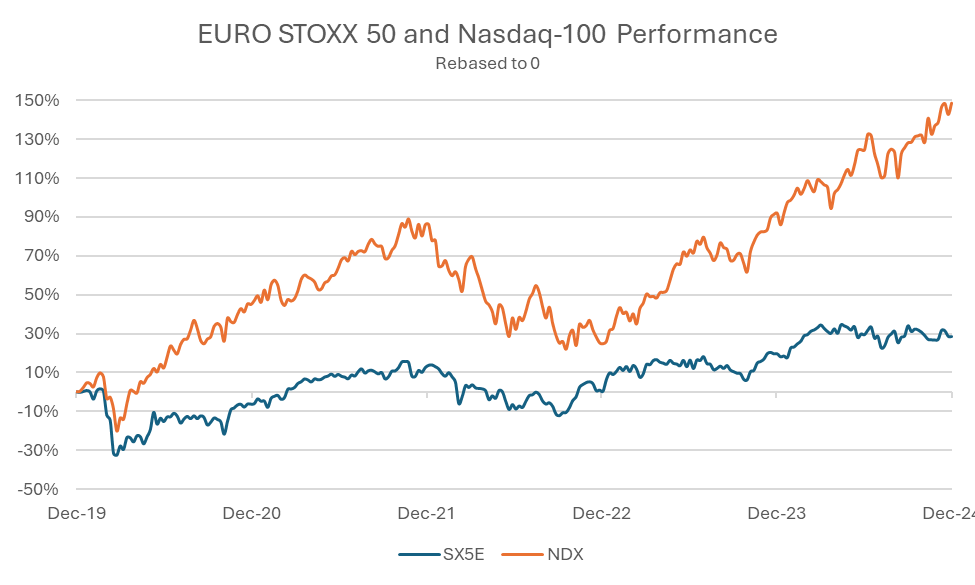

Corporate valuations in the EU paint a similarly sobering picture. The STOXX Europe 600, a broad equity index representing companies across the region, has underperformed its U.S. counterpart, the S&P 500, over the past five years. As of late 2024, the STOXX Europe 600 traded at an average price-to-earning (P/E) ratio of 15.86, significantly lower than the S&P 500’s P/E ratio of 28.51 and the Nasdaq composite’s ratio of 32.22. This valuation gap highlights investor concerns about the EU’s growth potential and the profitability of its companies. The market cap of the SX5E, the 50 largest companies in the EU, is around 3.54 trillion USD, whereas the Nasdaq 100, the 100 largest companies in the Nasdaq composite, is worth around 26.35 trillion USD, and 7.92 trillion USD when excluding the magnificent seven, remaining 2.2 times greater than the largest 50 companies in the EU. This suggests that innovation in Europe is becoming very limited and hence investors are unable to apply the growth multiples to EU stocks as much as they would do for US stocks.

Exhibit 2

Source: LSEG Workspace

Policymaking within the EU has also played a pivotal role in shaping the investment landscape, albeit with mixed outcomes. On one hand, the bloc’s ambitious climate goals, enshrined in the European Green Deal, have spurred significant investments in clean energy and sustainable infrastructure. The EU’s commitment to achieving carbon neutrality by 2050 has positioned it as a global leader in environmental stewardship, attracting capital to green technologies. However, these initiatives have not been without costs. Stricter environmental regulations have increased compliance burdens for traditional industries, curtailing their competitiveness and profitability. Additionally, the slow rollout of fiscal support programs in response to the energy crisis has drawn criticism for exacerbating economic disparities between member states.

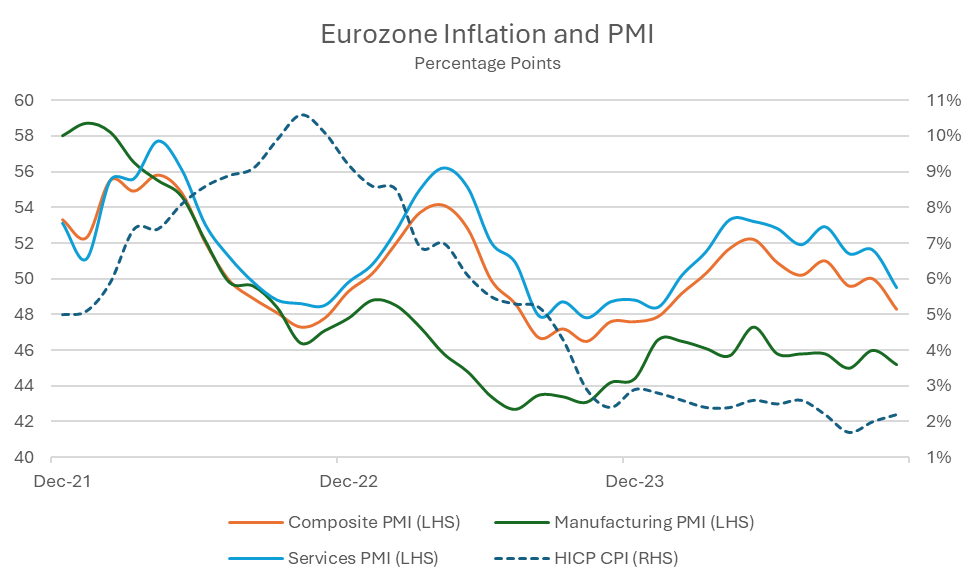

Monetary policy has also influenced the EU’s economic trajectory. The ECB’s decision to end its ultra-loose monetary stance in 2022, followed by successive interest rate hikes, aimed to curb inflation but inadvertently dampened business investment and consumer spending. With borrowing costs rising, many firms postponed expansion plans, while households tightened their budgets. Inflation in the eurozone peaked at 10.6% in October 2022 before gradually easing to around 2% by late 2024. Although this decline reflects the ECB’s success in managing price pressures, the accompanying slowdown in economic activity underscores the trade-offs inherent in monetary policy decisions as measured and indicated in Exhibit 3 under the region’s manufacturing and services PMIs.

Exhibit 3

Source: Eurostat

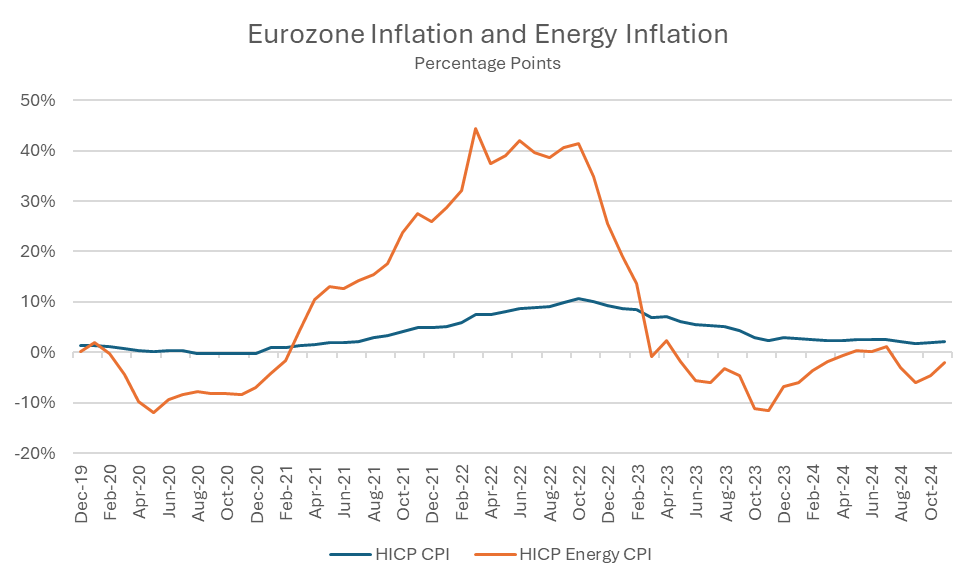

External factors have further compounded the EU’s challenges. The protracted war in Ukraine has disrupted energy supplies and trade routes, straining the bloc’s economic resilience. The EU’s heavy reliance on Russian natural gas left it vulnerable to price shocks, prompting an urgent pivot towards alternative energy sources. While this transition has accelerated the adoption of renewables, it has also exposed the region to short-term energy shortages and elevated costs which influenced energy inflation by an extreme margin as seen on Exhibit 4.

Exhibit 4

Source: Eurostat

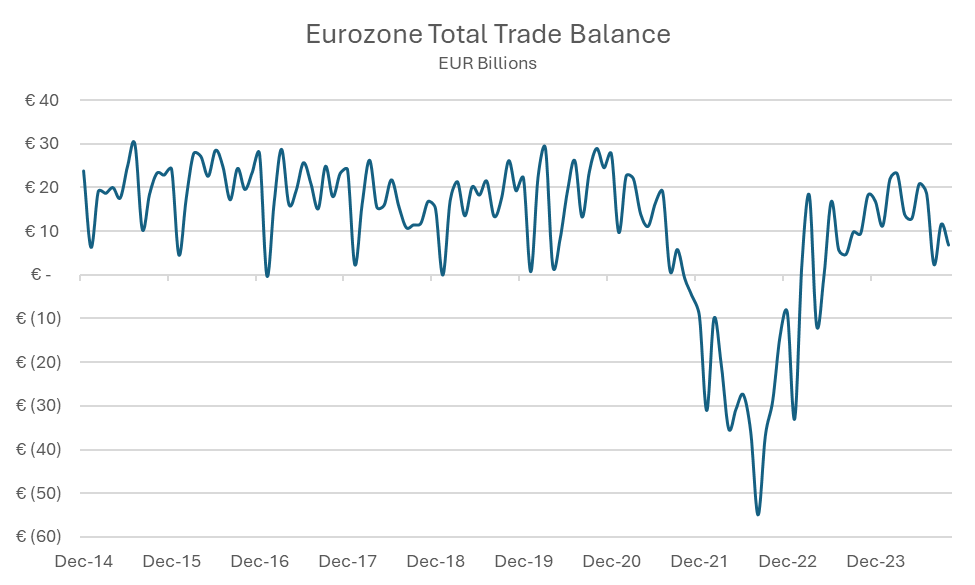

The EU’s export-oriented economies have also faced headwinds from slowing demand in key markets such as China and the United States, reducing trade surpluses that once served as a buffer against domestic weaknesses as seen on Exhibit 5. Furthermore, EU countries decoupling from China and pursuing a more deglobalized position has had adverse effects, raising domestic pricing for some goods and services and depleting competitiveness.

Exhibit 5

Source: Eurostat

From an investor’s perspective, the EU’s economic landscape is marked by both risks and opportunities. The region’s relative undervaluation compared to global peers could present attractive entry points for long-term investors willing to bet on its recovery. Thus, navigating the EU’s complexities requires a nuanced approach, as macroeconomic uncertainties and policy shifts could impact returns.

In conclusion, the EU’s investment appeal has been tempered by a confluence of slowing growth, uneven corporate performance, and the unintended consequences of policy decisions. For investors, the EU remains a region of contrasts, fraught with challenges but also with potential for those who can navigate its intricacies with foresight and adaptability. While valuations are depressed and seem appealing, we remain underweight the EU until we see a pivot in their macro-economic fundamentals and stronger policy making.

Contact:

Jinesh Rajpara, CFA

Investment Advisor

jinesh@mef.bh

+973-1711 1703

Yusuf Ahmed

Jr. Investment Analyst

yusuf@mef.bh

+973-1711 1700

Disclaimer: The information on this document should not be construed as legal, investment, financial, professional or any other advice. Content on this document does not represent or constitute any solicitation, inducement, recommendation, endorsement or offer by M E & F Holdings W.L.L. or any third-party service provider to buy or sell securities, commodities, digital assets, or any financial instruments. Nothing on the document constitutes professional and/or financial advice. The views expressed on this document are only of the author(s) and does not necessarily reflect the opinion of any other third party.