Populations on a global level are undergoing a significant transformation, characterized by an increasing proportion of elderly individuals within national populations. This trend carries profound economic implications that warrant comprehensive analysis. This article delves into the economic effects of aging populations, emphasizing key areas such as labor markets, economic growth, healthcare systems, and fiscal policies. We believe healthcare, pharmaceuticals, and long-term care services will experience heightened demand in the long term due to this transformation. Furthermore, some industries, such as travel and leisure, will need to adapt to cater to a changing customer base with specialized services and offerings.

Demographic Shifts and Projections

Population aging is a widespread phenomenon affecting both developed and developing nations. According to the United Nations, the median global age is projected to grow by 17% by 2050 as seen in Exhibit 1, with the over 60-year-old population almost doubling over the same period. In regions like Europe and North America, individuals aged 65 and above already constitute a significant share of the population, a trend expected to intensify in the coming decades. This demographic shift is primarily driven by declining fertility rates and increased life expectancy.

Exhibit 1

Source: United Nations

Impact on Labor Markets

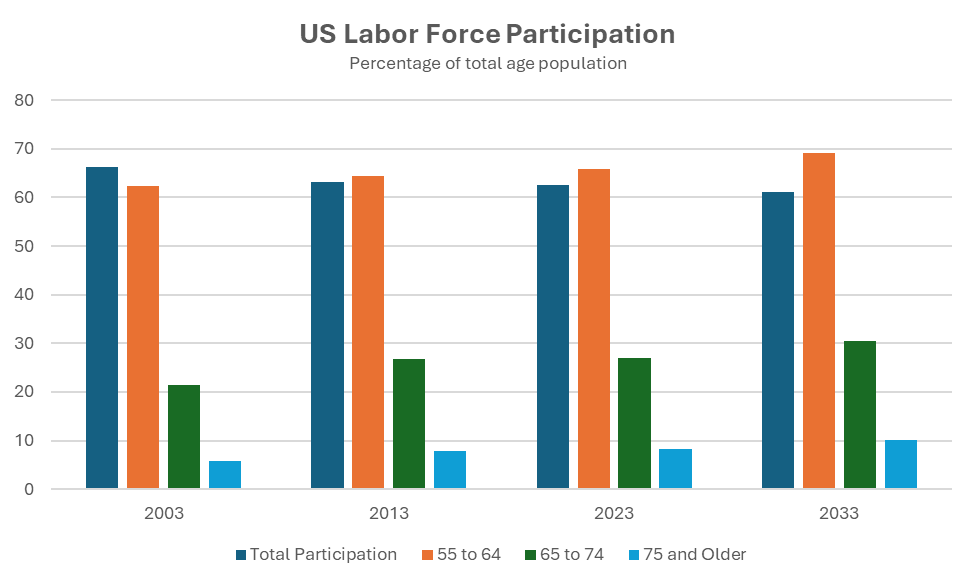

One of the most immediate economic consequences of an aging population is its effect on the labor market. As the proportion of retirees grows relative to the working-age population, countries may experience a contraction in their labor force. This shift can lead to labor shortages, potentially stymieing economic productivity and innovation. A study by the National Bureau of Economic Research found that a 10% increase in the fraction of the population aged 60 and over could decrease per capita GDP by 5.5% in the US, primarily due to reduced labor force participation and productivity. Furthermore, the US Bureau of Labor Statistics forecasts a growing participation rate from older age categories, with 55 and older growing over the next 10 years while total participation declines as shown in Exhibit 2.

Exhibit 2

Source: US Bureau of Labor Statistics

To mitigate these challenges, some nations are implementing policies aimed at extending working lives. Increasing the retirement age and promoting lifelong learning initiatives can help maintain a larger, more skilled workforce. Additionally, embracing automation and technological advancements may offset potential declines in labor supply by enhancing productivity.

The aging population trend poses significant challenges to economic growth and productivity. A shrinking workforce can lead to a slowdown in economic expansion, as fewer workers are available to contribute to production and innovation. A study published in the American Economic Journal indicated that from 1980 to 2010, population aging reduced the per-capita GDP growth rate by 0.3 percentage points annually in the United States.

To counteract these effects, countries might invest in education and training programs to enhance the productivity of the existing workforce. Encouraging higher labor force participation among underrepresented groups, such as women and minorities, can also help sustain economic growth.

Healthcare Systems and Expenditures

According to Eurostat, the old-age dependency ratio in Europe is projected to reach 57% by 2050, meaning fewer than two working-age individuals will support each retiree. This imbalance intensifies pension obligations, increasing fiscal pressures. A report by the EU Directorate-General for Economic and Financial Affairs estimates that public pension spending in the EU will rise from 11.3% to nearly 12.8% of GDP by 2050, straining government budgets. To address these challenges, policymakers may need to implement pension reforms such as raising retirement ages, modifying benefit structures, and incentivizing private retirement savings to maintain long-term fiscal stability.

Aging populations significantly heighten demand for medical services, long-term care, and pharmaceuticals, putting immense pressure on healthcare infrastructure and public spending. Governments may need to expand healthcare infrastructure, invest in preventative medicine, and encourage private sector involvement to manage these rising costs effectively.

The growing elderly population also influences consumer behavior, with increased demand for products and services tailored to their needs. Sectors such as healthcare, pharmaceuticals, travel, and leisure may experience growth as they cater to the preferences of older consumers. Businesses that adapt to these changing demographics can capitalize on new market opportunities.

For example, the healthcare industry may see a rise in demand for medical devices and home care services. The travel sector could develop offerings that accommodate the preferences and mobility considerations of older travelers. Understanding and responding to the evolving needs of an aging population can drive innovation and economic activity in various industries.

Conclusion

Aging populations have had clear economic implications, affecting labor markets, economic growth, healthcare systems, and fiscal policies. Addressing these challenges requires comprehensive strategies that encompass policy reforms, investments in human capital, and adaptations to changing consumer behaviors. By proactively responding to demographic shifts, societies can mitigate potential drawbacks and industries can harness new opportunities.

Contact:

Jinesh Rajpara, CFA

Investment Advisor

jinesh@mef.bh

+973-1711 1703

Yusuf Ahmed

Jr. Investment Analyst

yusuf@mef.bh

+973-1711 1700

Disclaimer: The information on this document should not be construed as legal, investment, financial, professional or any other advice. Content on this document does not represent or constitute any solicitation, inducement, recommendation, endorsement or offer by M E & F Holdings W.L.L. or any third-party service provider to buy or sell securities, commodities, digital assets, or any financial instruments. Nothing on the document constitutes professional and/or financial advice. The views expressed on this document are only of the author(s) and does not necessarily reflect the opinion of any other third party.