In today’s transition towards a greener and more sustainable world, critical minerals and rare earth elements have become not only essential industrial inputs but strategic geopolitical assets. Control over these materials is increasingly driving international power dynamics, trade policy, and investment flows. Countries are scrambling to secure supply chains, diversify sourcing, and foster domestic production, shaping a new era of mineral diplomacy with significant implications for investors. Sectors poised to benefit include mining and processing operations, recycling and urban mining firms, downstream technology producers, and infrastructure developers catering to resilient supply chains.

The Current Landscape

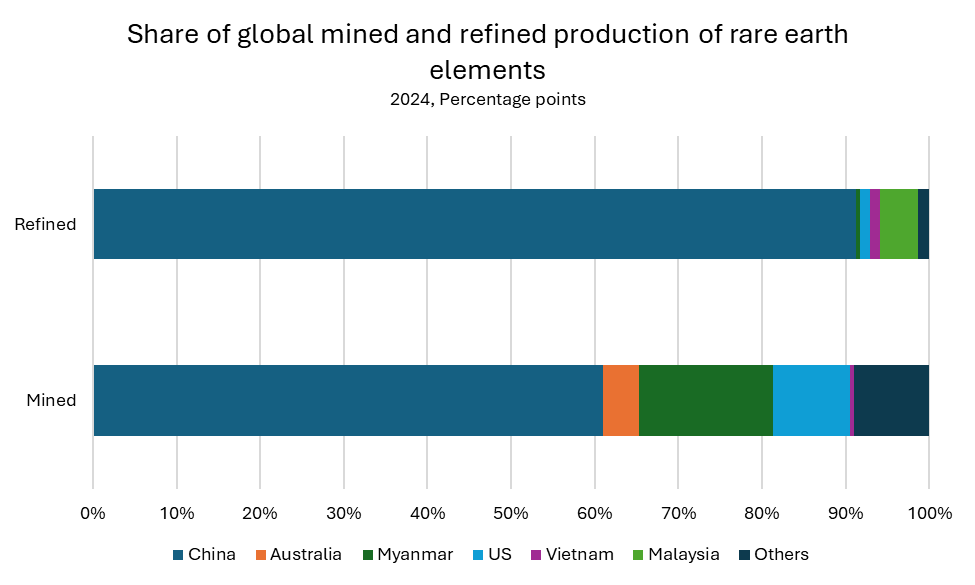

China continues to dominate the rare earth element (REE) value chain, mining around 60% of the global supply and refining up to 90% of the global supply as shown in Exhibit 1. This asymmetric control gives China potent leverage: in 2010, during tensions with Japan, China temporarily halted REE exports, jolting global markets. More recently in 2023, China applied export restrictions on Gallium and Germanium and banned the export of REE processing technologies, further entrenching its dominance over global supply chains.

Exhibit 1

Source: International Energy Agency

In response, the U.S., EU, India, and others are mounting strategic efforts to de-risk dependencies and reshape supply chains.

- United States: The US has placed mineral security at the center of its strategic agenda through the Minerals Security Partnership (MSP), a coalition of like-minded allies including Japan, South Korea, Australia, and Canada. The MSP focuses on mobilizing public and private capital for projects that ensure resilient supply chains. Recent U.S. investments demonstrate how this strategy is taking shape: companies such as Vulcan Elements, a rare earth element manufacturer, have raised $65 million in financing due to the push to onshore production from the US. These targeted interventions highlight a coordinated effort to reduce exposure to China’s dominance while boosting allied industrial bases.

- European Union: The EU’s Critical Raw Materials Act is underpinned by over €10 billion in dedicated funding aimed at building a secure and diversified mineral ecosystem. According to the European Raw Materials Alliance, this capital is expected to flow primarily into three channels: developing new mining projects within the bloc; scaling up midstream processing capacity to capture more of the value chain; and expanding recycling facilities to meet the EU’s target of sourcing 25% of demand through recycled inputs by 2030. Together, these investments are designed to reduce reliance on single external suppliers and accelerate the region’s green transition.

- India: India is also advancing its mineral security agenda through legal reforms that allow the state to finance overseas mineral acquisitions. The government recently amended mining regulations to provide state-owned enterprises with authority to pursue critical mineral assets abroad, from lithium in South America to cobalt in Africa. By leveraging state financing, India hopes to catch up with other major powers in securing long-term access to vital resources, while simultaneously fostering domestic capacity in refining and manufacturing.

Investment Implications

From an investment standpoint, mineral diplomacy introduces both risks and opportunities. On the risk side, concentrated supply chains heighten exposure to political decisions and trade disputes. Export bans, new tariffs, or diplomatic tensions can abruptly disrupt access to key inputs, creating sudden and severe market shocks. Investors who are heavily exposed to vulnerable geographies or reliant on single-source suppliers face particular challenges navigating these disruptions.

On the opportunity side, the redirection of capital into mining, processing, and refining outside of China is opening a new investment environment. Companies positioned upstream in the value chain, such as mining operators or refiners in the U.S., Canada, and Australia, stand to gain from policy incentives and strategic funding. Equally important are recycling and urban mining firms, which are becoming critical players in the circular economy as governments and corporations emphasize sustainability and supply resilience.

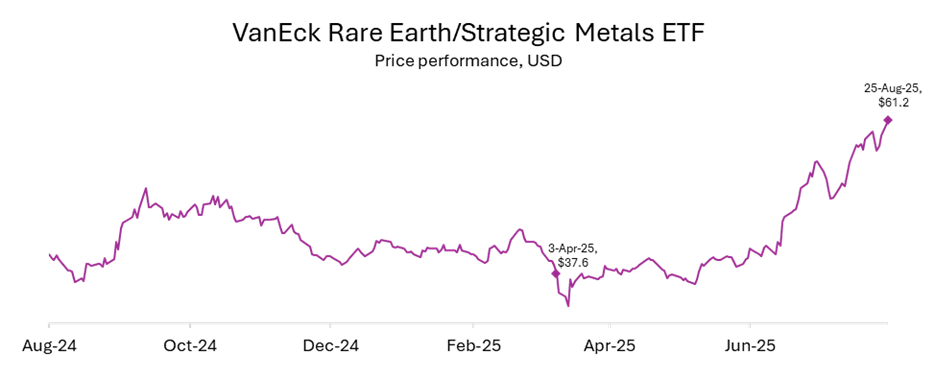

Exhibit 2 presents the VanEck Rare Earth and Strategic Metals ETF which provides exposure to global companies involved in the mining, refining, and recycling of rare earth and strategic metals. Following the major announcement on 4 April 2025 when China imposed export restrictions on 7 rare earth metals, the ETF price soared from 37.6 a day before to 61.2 per share as on 25 Aug 2025 indicating a growth of 62.8 per cent.

Exhibit 2

Source: LSEG Workspace

Although achieving true diversification away from China’s supply chain will demand immense capital and technological investment, a process that will take years to complete. Further, the IEA projects only marginal ex-China diversification through even as late as 2035. Companies such as JL Mag, Yunsheng and XTG are expected to benefit from this dominance in the market. Despite this, other players within this space are making concrete efforts towards that direction.

For instance, US rare-earth miner and magnet manufacturer MP Materials signed historic agreements worth USD 900 Mn with the US Department of Defense and Apple for the supply of rare-earth magnets.

Policy Imperatives and Future Outlook

Ensuring stable critical mineral supply requires careful policy design. The UN-backed proposed Global Minerals Trust, akin to a Bretton Woods system for green technologies, could stabilize supplies while enforcing environmental and development safeguards, but faces resistance from major players unwilling to relinquish control.

Looking ahead, demand for minerals such as lithium, graphite, and rare earths is projected to grow several-fold by 2030, driven by the rise of EVs, renewables, and digital infrastructure. According to the International Energy Agency (IEA), demand for lithium alone could increase more than 40 times by 2040 under ambitious net-zero scenarios. This explosive growth underscores the urgent need for diversified supply chains and continued investment in both extraction and recycling capacity.

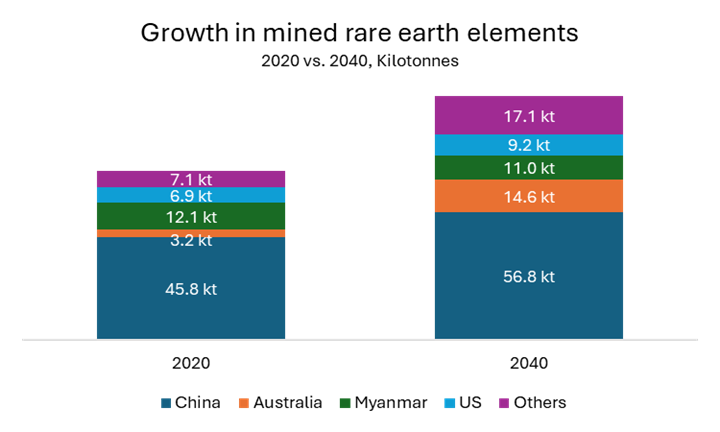

Exhibit 3

Source: International Energy Agency

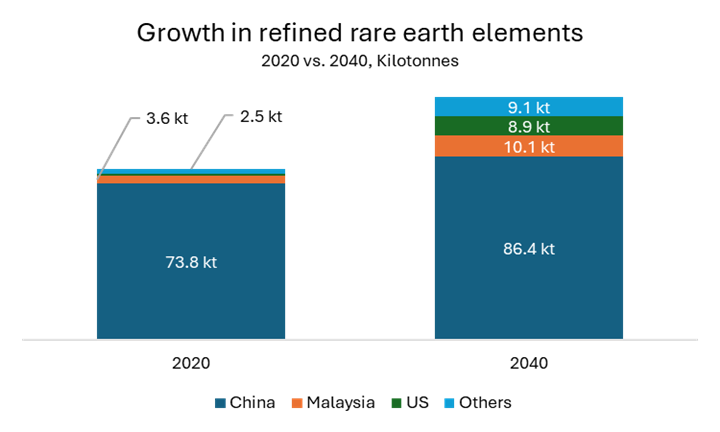

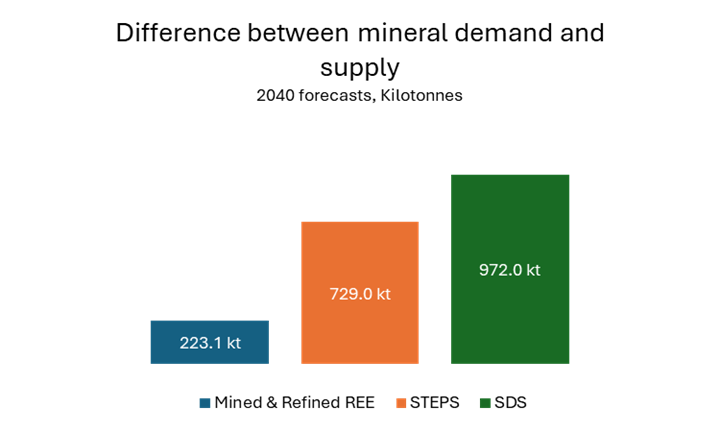

Despite the growth and diversification that is expected in the supply of REE, both in refined and mined forms, there is still a very stark gap in the demand and supply of these critical elements. This is primarily due to the central role they play as vital components in clean energy technologies like electric vehicles, wind turbines, and solar panels. Estimates from the IEA, as shown in Exhibit 3 and 4, point that the demand for REE is expected to reach 729 kt in 2040 under the Stated Policies Scenario (STEPS) which is a projection of the global energy requirements based on policies and measures that governments have already implemented or have made firm. This is also estimated to increase to 972.0 kt in 2040 by the IEA under the Sustainable Development Scenario, a scenario which is designed to show what would be required to achieve a three-fold objective of limiting the increase in the global average increase in temperature to 1.5 °C.

Exhibit 4

Source: International Energy Agency

Conclusion

Critical minerals have become a structural element of both economic planning and geopolitical competition. Their role is expanding as the global economy transitions toward low-carbon technologies and digital infrastructure, placing pressure on supply chains that remain highly concentrated. For investors, this landscape presents a mix of risks related to volatility, regulation, and political intervention, alongside opportunities in the countries attempting to derisk themselves from the current supply chain through their own initiatives.

Contact:

Anirudh Kar, CFA

Investment Associate

anirudh@mef.bh

+973-1711 1700

Yusuf Ahmed

Sr. Investment Associate

yusuf@mef.bh

+973-1711 1700

Disclaimer: The information on this document should not be construed as legal, investment, financial, professional or any other advice. Content on this document does not represent or constitute any solicitation, inducement, recommendation, endorsement or offer by M E & F Holdings W.L.L. or any third-party service provider to buy or sell securities, commodities, digital assets, or any financial instruments. Nothing on the document constitutes professional and/or financial advice. The views expressed on this document are only of the author(s) and does not necessarily reflect the opinion of any other third party.