Global manufacturing is undergoing a structural transformation. For decades, multinational corporations optimized production by offshoring to low-cost destinations, primarily in Asia, to maximize efficiency and margins. However, a convergence of factors, rising geopolitical tensions, pandemic-driven supply chain shocks, climate risks, and technological advances in automation, is pushing firms to reconfigure their production strategies. The result has been a notable rise in reshoring (bringing production back to a company’s home country) and nearshoring (relocating production closer to end markets).

This transition carries wide-ranging implications. Sectors such as industrial real estate, logistics, transportation, and manufacturing stand to benefit as firms prioritize resilience, shorter supply chains, and greater control over production processes. At the same time, economies positioned as nearshoring destinations, notably Mexico, parts of Eastern Europe, and Southeast Asia, are emerging as winners in the new geography of global manufacturing.

The Current Landscape

The vulnerabilities of global supply chains became highly visible during the COVID-19 pandemic, when shortages in semiconductors, medical equipment, and shipping capacity disrupted industries worldwide. According to UNCTAD, global merchandise trade fell by 7.2% in 2020, the sharpest contraction since the global financial crisis.

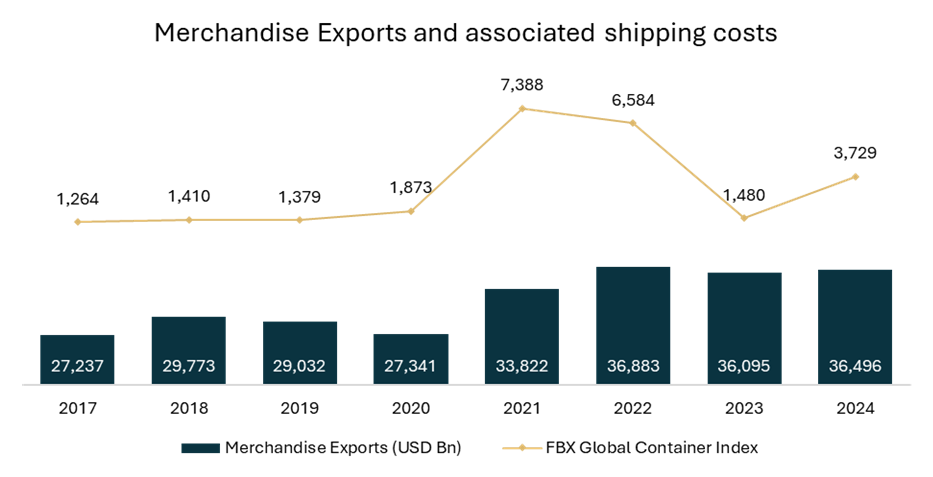

Rising U.S.–China tensions have also accelerated the rethink. The U.S. has implemented tariffs and technology restrictions, while the EU has introduced stricter due diligence rules on supply chains. Meanwhile, freight costs, which peaked at over 3.5x where current prices are per container from China in January 2022, highlighted the risks of distance and overdependence on a single geography.

Exhibit 1

Source: Merchandise Exports – World Trade Organization, FBX Global Container Index – LSEG

Note: FBX Global Container Index values presented as yearly average.

Technology is also changing the cost equation. Advances in technology are reducing the traditional labor-cost advantages of offshore locations. This makes reshoring and nearshoring more economically viable, especially for industries with high value-added, time-sensitive, or strategically sensitive production.

Global Responses

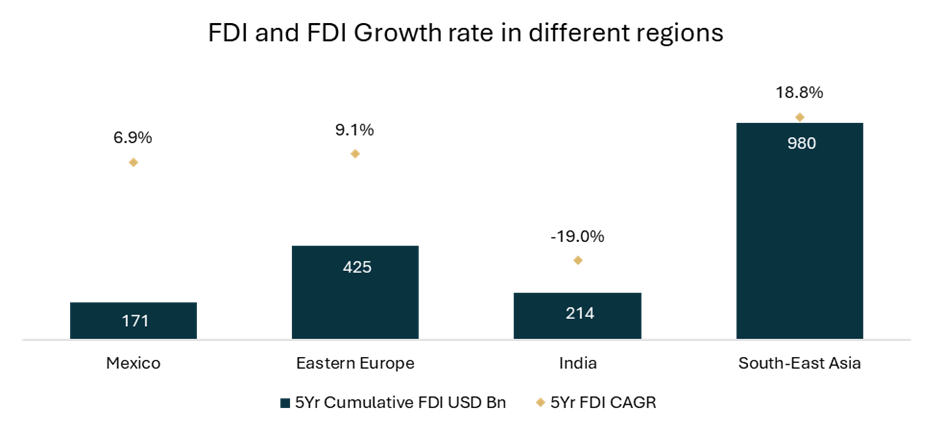

United States: U.S. policymakers have actively promoted reshoring in strategic sectors, particularly semiconductors and clean energy. The CHIPS and Science Act has unlocked $39 billion in subsidies for domestic semiconductor manufacturing, leading to major investments by Intel, TSMC, and Samsung in new U.S. fabrication plants. Simultaneously, companies are diversifying manufacturing to Mexico, leveraging the USMCA trade framework, lower labor costs, and geographical proximity. Mexico has already seen net foreign direct investment inflows of almost $44 billion in 2024, with much of it tied to nearshoring projects.

European Union: Europe has also embraced nearshoring, with Eastern and Southern Europe benefiting as companies diversify away from Asia. Poland, Hungary, and the Czech Republic are attracting automotive and electronics supply chains, while Portugal and Spain are seeing rising interest in textiles and renewable technology manufacturing.

India and Southeast Asia: India has positioned itself as an alternative to China through initiatives such as the Production-Linked Incentive scheme, which offers financial support to manufacturers in electronics, pharmaceuticals, and renewable energy. Apple, for instance, produced nearly 14% of its iPhones in India in 2023, a sharp rise from under 1% five years earlier. Meanwhile, Southeast Asian economies, particularly Vietnam, Thailand, and Indonesia, are absorbing investment in electronics, automotive components, and consumer goods manufacturing as part of a “China+1” strategy.

Exhibit 2

Source: UNCTAD

Investment Implications

The trend toward reshoring and nearshoring presents a dilemma to investors. On one hand, there are challenges, with companies facing higher upfront costs when relocating supply chains, and nearshoring economies must rapidly expand infrastructure to meet demand. On the other hand, opportunities are substantial. Industrial real estate is a beneficiary as demand for warehouses, logistics hubs, and specialized manufacturing facilities is bound to surge.

Logistics is also poised to benefit, with infrastructure expansions prompted as ports in nations of interest start seeing more traffic. In addition, manufacturing and automation technology providers stand to capture long-term growth. This sector is already seeing robust investment flows, particularly in Europe and Japan, where automation density is among the highest globally.

Policy Imperatives and Future Outlook

Reshoring and nearshoring are not simply market-driven phenomena; they are deeply shaped by government policy. Industrial strategies, subsidy programs, and trade agreements are critical to sustaining momentum. However, protectionist tendencies also pose risks. Overly restrictive rules could fragment global trade further, increasing costs and inefficiencies.

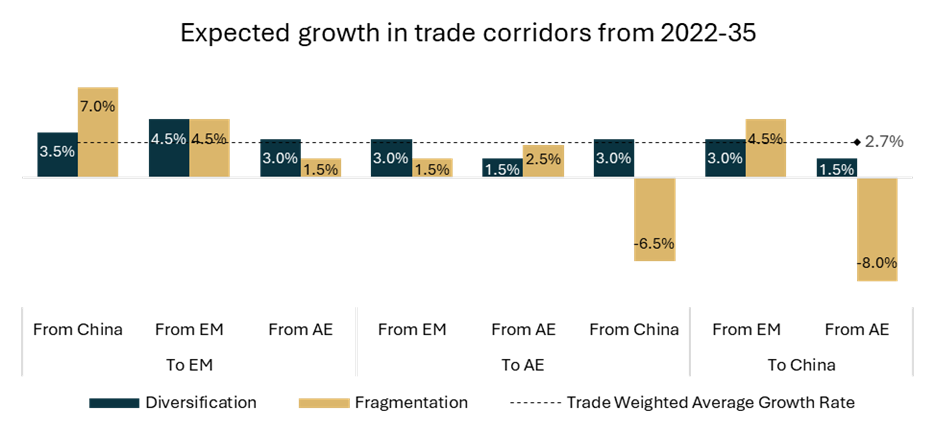

Looking ahead, global trade is unlikely to return to its pre-pandemic globalization trajectory. Instead, it is shifting toward a regionalized model, where supply chains cluster around major consumption markets. According to McKinsey, by 2035, over 30% of global trade could shift to new locations. The study examines two scenarios, namely the ‘Diversification scenario’ and the ‘Fragmentation scenario’. The ‘Diversification scenario’ explores the expected growth in trade based on how trade might shift through widespread action by companies across sectors to diversify their sources of supply. The ‘Fragmentation scenario’ is based on a position of increased trade frictions across countries that are geopolitically distant. Exhibit 3 shows that trade corridors into emerging markets are expected to grow highest due to the diversification of supply chains much higher than the trade weighted average growth rate of 2.7% between 2022-35.

Exhibit 3

Source: McKinsey – A new trade paradigm: How shifts in trade corridors could affect business.

Note: EM = Emerging Markets; AE = Advanced Economies (US, Canada, Europe, Australia/New Zealand, Japan, South Korea)

Conclusion

The reconfiguration of global manufacturing through reshoring and nearshoring marks one of the most significant structural shifts in international trade. While cost considerations remain important, resilience, security, and geopolitical alignment are increasingly decisive factors. For investors, this trend underscores both the risks of legacy exposure to concentrated offshore supply chains and the opportunities in sectors and geographies positioned to benefit from the new industrial map. Long-term success will depend on careful assessment of regional strengths, policy frameworks, and the technology driving localized production.

Contact:

Anirudh Kar, CFA

Investment Associate

anirudh@mef.bh

+973-1711 1700

Yusuf Ahmed

Sr. Investment Associate

yusuf@mef.bh

+973-1711 1700

Disclaimer: The information on this document should not be construed as legal, investment, financial, professional or any other advice. Content on this document does not represent or constitute any solicitation, inducement, recommendation, endorsement or offer by M E & F Holdings W.L.L. or any third-party service provider to buy or sell securities, commodities, digital assets, or any financial instruments. Nothing on the document constitutes professional and/or financial advice. The views expressed on this document are only of the author(s) and does not necessarily reflect the opinion of any other third party.