The relentless global surge toward Artificial Intelligence and sustainability goals has created an unprecedented energy crisis. Fuelling the colossal, round-the-clock demands of AI data centres requires a baseload power source that is both massive in scale and zero-carbon—a requirement that places nuclear energy at the centre of the technology revolution. This dynamic has fundamentally rewired the supply-demand equation for its primary fuel. With geopolitical factors constricting global output and new reactors planned worldwide to secure AI’s power needs, a structural deficit is appearing. The essential commodity, Uranium, is now poised as a strategic investment, transforming from a niche resource into the critical element powering the future of computation.

Introduction – What Uranium Is and Why It Matters

Uranium is a dense, silvery-grey radioactive metal found in rocks and soils. Of its many isotopes, only uranium‑235 or U-235 can sustain the chain reactions that generate nuclear power. A single kilogram of U‑235 releases as much energy as 2,700 tons of coal, making it one of the most concentrated energy sources on Earth.

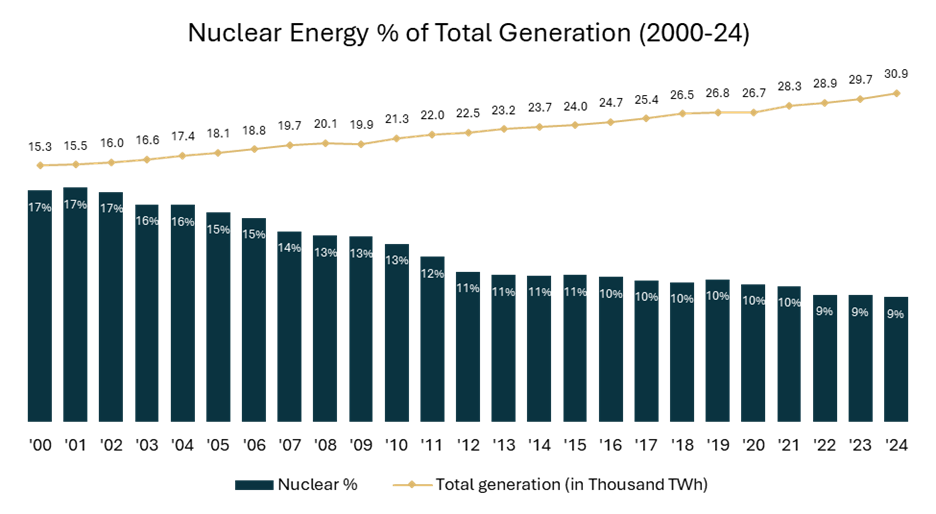

Recently, global nuclear power generation reached a new peak in 2024 at 2,778 TWh, growing by 2.9% (78 TWh) after a similar rise in 2023 (2.3%). However, despite this record output, nuclear energy’s share of the global electricity mix fell to its lowest point in over 45 years—just 9%.

Source: Ember – Global Electricity Review 2025

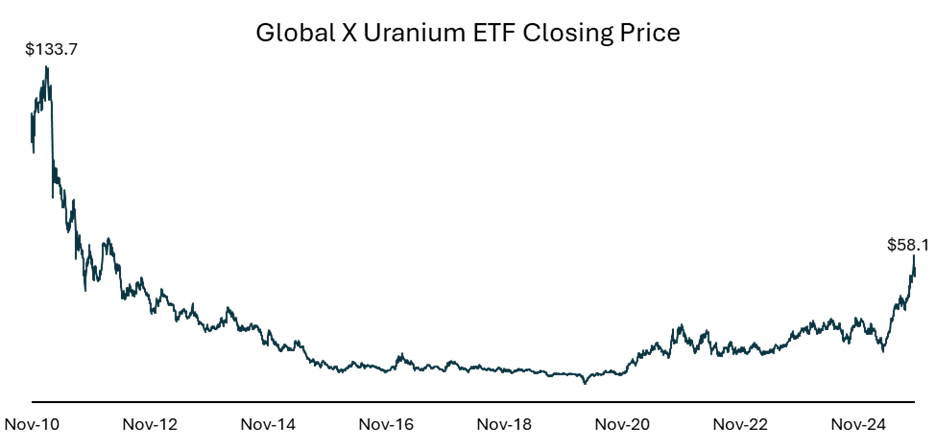

This long-term decline reflects the declining popularity of nuclear energy as a source. As a result, the once growing demand for uranium as an energy source took a sharp turn particularly after the events of the Fukushima disaster in 2011. The Fukushima disaster occurred when a massive earthquake and tsunami disabled the Fukushima Daiichi nuclear power plant in Japan, causing meltdowns and radioactive leaks. It was rated as level seven on the International Nuclear Event Scale, matching the severity of Chernobyl.

The event sparked global fear over nuclear safety and led to widespread public opposition to nuclear energy. Countries like Germany, Italy, and Switzerland accelerated nuclear phaseouts, while global confidence in nuclear power sharply declined, marking the end of a brief “nuclear renaissance” and reigniting scepticism toward its safety. As a result, the Global X Uranium ETF, an ETF tracking nuclear energy producers and miners, declined sharply thereafter.

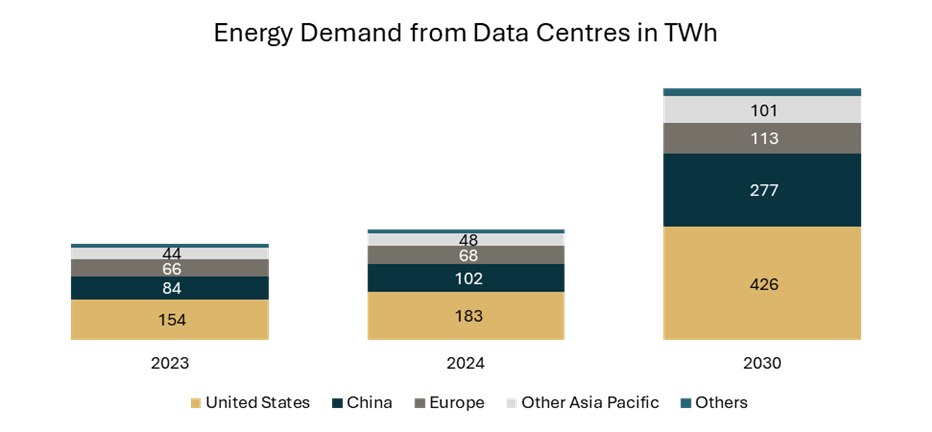

The AI Boom: Reviving Uranium Demand

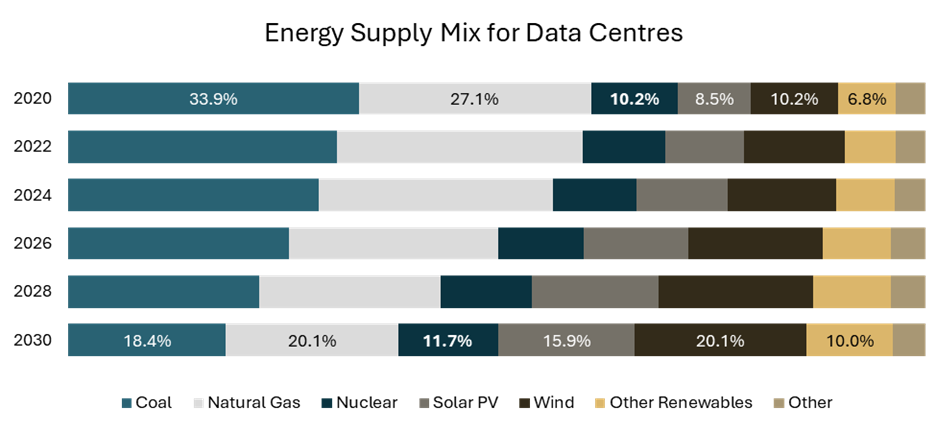

However, the sentiment around nuclear energy and thus demand for Uranium is changing. Artificial intelligence has triggered a surge in electricity consumption which is providing early tailwinds for demand for Uranium. Global data centre power demand could rise from 416 TWh in 2024 to 946 TWh by 2030 increasing 127%, equalling Japan’s annual usage, according to the IEA. Training and deploying AI systems rely on continuous, high-load energy—training of large models like GPT‑3 alone consumed energy comparable to that used by 120 homes over a year.

This relentless power need underscores nuclear energy’s appeal. Unlike wind or solar, nuclear plants maintain over 90% reliability—crucial for AI data centres running 24/7. With carbon emissions near zero, uranium-fuelled reactors meet both clean power standards and operational uptime requirements of tech infrastructure.

Small Modular Reactors (SMRs): Disrupting the traditional nuclear market.

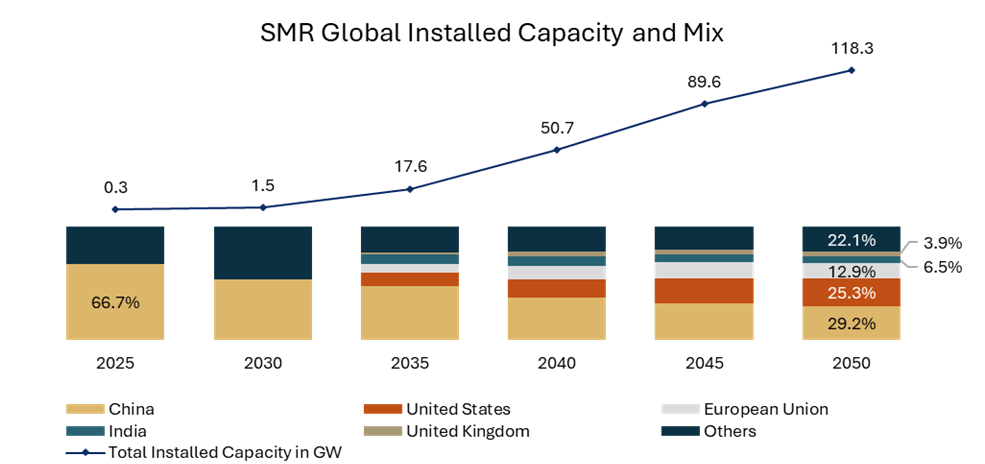

Small modular reactors are changing market dynamics for nuclear energy. A Small Modular Reactor (SMR) is a specialised type of nuclear reactor with an electrical output typically up to 300 megawatts, about one-third of a conventional nuclear power plant. SMRs are compact, modular, and they are designed to be assembled in factories and transported to installation sites, which streamlines construction and allows for flexible scaling of energy production. SMRs generate between 50–300 megawatts, providing flexible deployment at lower cost than traditional reactors.

Major technology firms are already investing. Google contracted Kairos Power for molten-salt SMRs to feed its servers, Microsoft partnered with Constellation Energy to restart Three Mile Island Unit‑1, and Amazon funded X‑Energy’s 320 MW reactor project in Washington state.

Experts predict 100–200 SMRs globally by 2040, translating to 30–60% growth in annual uranium consumption. Many designs require High-Assay Low-Enriched Uranium (HALEU), adding demand pressure to enrichment facilities.

Source: IEA – The Path to a New Era for Nuclear Energy

Demand and Supply Outlook: Tightening Markets

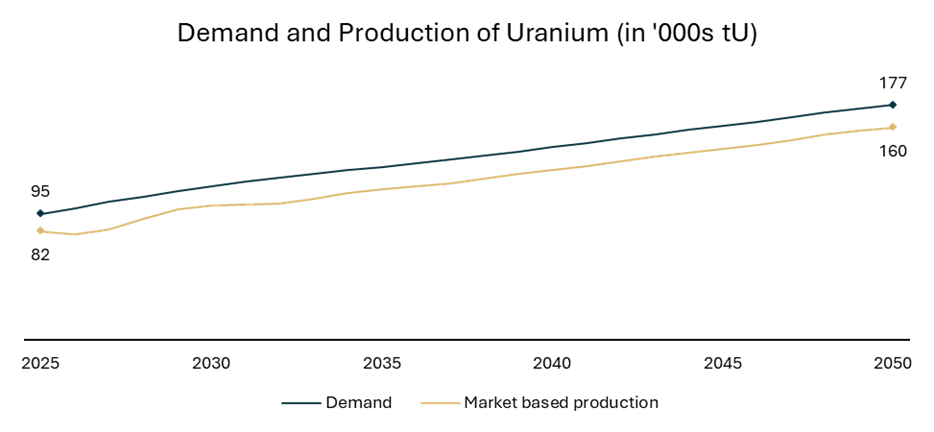

The Internation Atomic Energy Association (IAEA) forecasts uranium demand will rise 86% from 2025-2050 as global nuclear capacity expands from 398 GW to more than 750 GW. Rapid growth in SMRs and reactor fleet additions will outpace current output.

However, supply is still constrained. Active mines produce 60,000–65,000 tonnes per year, insufficient to meet fast-rising consumption. Secondary supplies—stockpiles and recycled fuel—are dwindling. New mines require 7–10 years of development, limiting short-term capacity expansion.

Recent cuts in announced in uranium output by Kazakhstan and Niger’s (which collectively supply more than 1/3rd of global uranium) instability have reduced global flexibility just as utilities are returning to long-term contracts. IAEA estimated suggest of a supply shortfall of 17,000 tonnes by 2050.

Source: IAEA – Analysis of Uranium Supply to 2050

Global Policy Push to Secure Uranium

Governments recognize uranium’s strategic value and are strengthening domestic reserves:

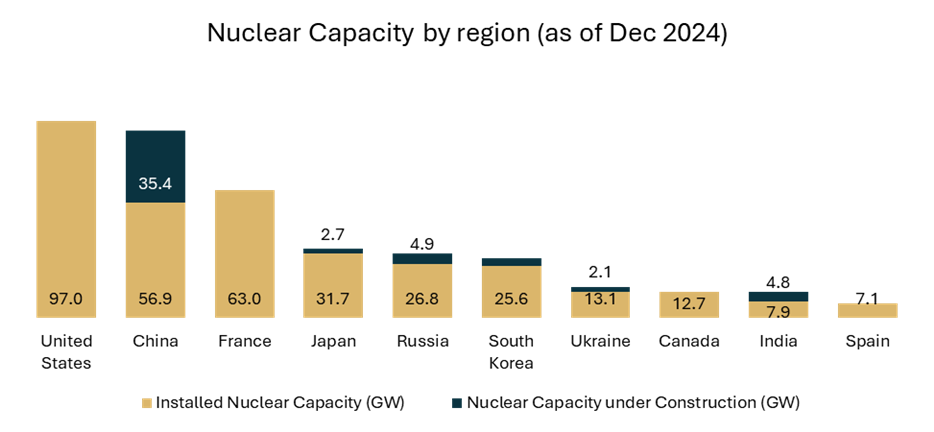

China: China’s nuclear expansion, guided by the 14th Five-Year Plan (2021–2025), which targets 70 GW of installed capacity by the end of 2025 and outlines a path toward 200 GW by 2035. This translates to about 6–8 new reactors added annually, with most projects completed within seven years—far faster than in Western countries. Nuclear energy’s share of China’s total electricity is expected to rise from 5% in 2024 to 10% by 2040.

China is also actively investing in domestic uranium exploration and production, diversifying its supply sources internationally, and building strategic stockpiles—all aimed at supporting its ambitious nuclear expansion while minimizing reliance on foreign sources.

United States: In 2025, the Trump administration launched a $900 million nuclear fund and expanded the U.S. strategic uranium reserve. New rules mandate utilities to end Russian uranium imports by 2028, prompting renewed domestic mining initiatives.

India: The government now allows private uranium mining and import to support its goal of 100 GW nuclear capacity by 2047—ending decades of state monopoly and creating new demand.

Japan & France: Japan has restarted 13 reactors under new safety standards; France is still Europe’s nuclear leader, generating 70% of its electricity from uranium and investing €1 billion in its NUWARD SMR project under the France 2030 plan.

Canada: Ontario Power Generation is building North America’s first grid-scale SMR at Darlington, a $6 billion project needing over 1,000 tonnes of uranium annually.

Source: World Nuclear Association – Reactor Database

Uranium is once again resurging in importance and may prove vital to the global economy—linking clean energy goals with the AI-driven digital boom. As nations rebuild nuclear fleets and corporations look for reliable, carbon-free power, a structural supply‑demand imbalance is solidifying.

With delayed mine development and accelerating technology investment, uranium’s importance now extends far beyond energy markets—it underpins future technological sovereignty, grid stability, and economic growth. For investors, this marks a rare moment where policy, innovation, and scarcity converge to thrust uranium to the centre of the 21st-century clean‑tech revolution.

Contact:

Anirudh Kar, CFA

Investment Associate

anirudh@mef.bh

+973-1711 1700

Yusuf Ahmed

Sr. Investment Associate

yusuf@mef.bh

+973-1711 1700

Disclaimer: The information on this document should not be construed as legal, investment, financial, professional or any other advice. Content on this document does not represent or constitute any solicitation, inducement, recommendation, endorsement or offer by M E & F Holdings W.L.L. or any third-party service provider to buy or sell securities, commodities, digital assets, or any financial instruments. Nothing on the document constitutes professional and/or financial advice. The views expressed on this document are only of the author(s) and does not necessarily reflect the opinion of any other third party.