Introduction

The U.S. housing market is navigating a period of acute supply shortages, persistent price strength, and historically high mortgage rates. Despite a substantial tightening in monetary policy, home prices remain near record levels, underscoring the enduring supply-demand mismatch in the sector. While these structural imbalances highlight long-term opportunities for homebuilders, ongoing operational and financial challenges are straining the industry’s resilience and profitability.

Post-Pandemic Monetary Policy and Housing Dynamics

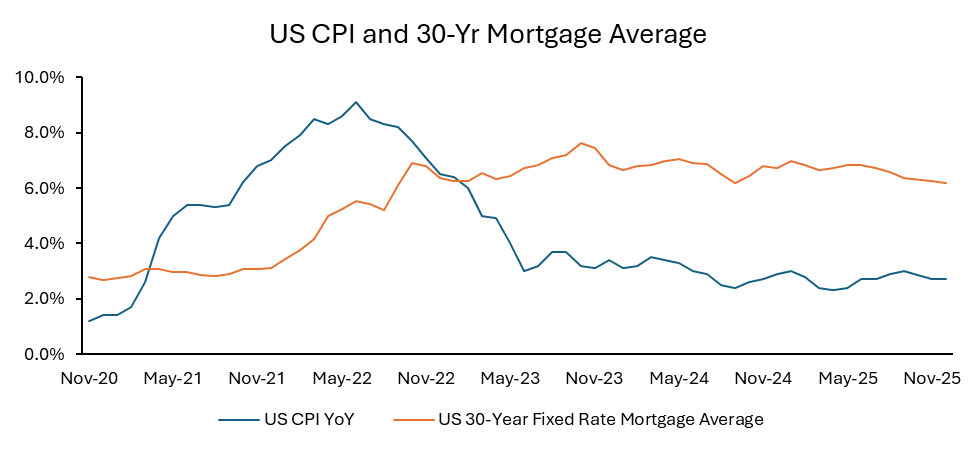

In the aftermath of the COVID-19 pandemic, the U.S. economy experienced inflation driven by aggressive fiscal stimulus and supply chain disruptions. The Consumer Price Index (CPI) peaked at 9.1% in June 2022, the highest since 1981, far exceeding the Federal Reserve’s target of 2%. In response, the Federal Open Market Committee rapidly increased the federal funds target range to 5.25–5.50% by mid-2023, the steepest cycle since the 1980s, pushing mortgage rates to multi-decade highs.

Source: U.S. Bureau of Labor Statistics, Freddie Mac

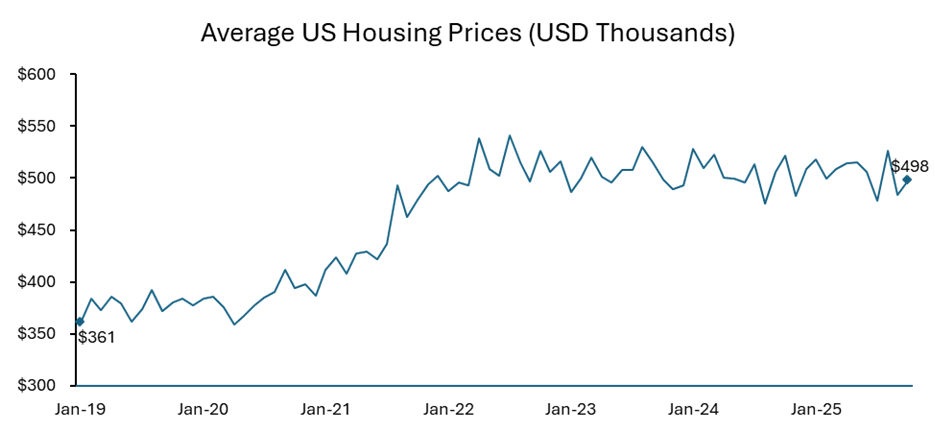

Typically, such rate hikes would depress housing demand and moderate prices. However, the entrenched lack of housing supply has kept price pressures elevated. From 2019 to 2025, average home prices climbed sharply, bringing the average single-family home price to close to USD 500 thousand.

Source: U.S. Census Bureau

The Lock-In and the Demand-Supply Paradox

The housing market faces a unique combination of weak demand and tight supply. Single-family housing permits and starts, which plunged after the 2008–09 financial crisis, have failed to return to historical averages for more than a decade, leaving a chronic deficit. By 2025, estimates from national sources including Freddie Mac, the National Association of Realtors, and Goldman Sachs place the U.S. housing shortage between 3.5 and 5.5 million units.

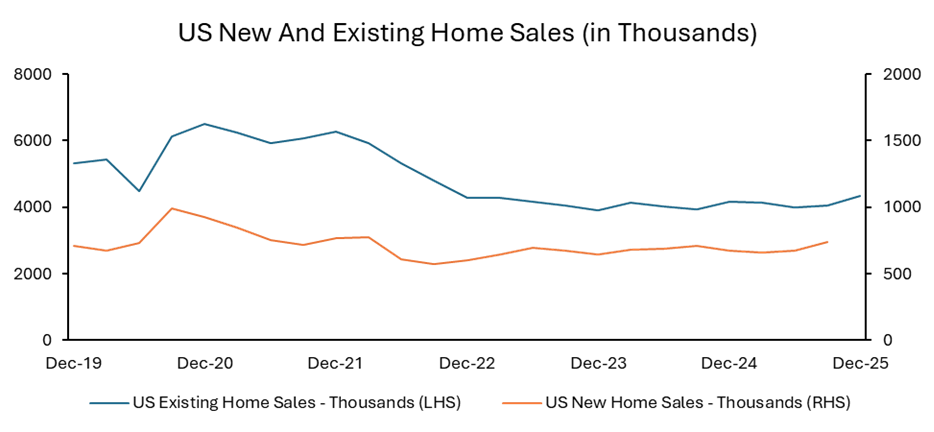

Further compounding the shortage is the so-called “lock-in effect.” According to research from Redfin, over half of all U.S. mortgage holders have rates below 4%; with prevailing rates above 6%, homeowners have little incentive to sell, preferring to retain their lower monthly payments rather than face much higher costs on a new purchase. This dynamic continues to reduce available supply, even as new construction has improved slightly from pandemic lows.

Source: U.S. Census Bureau

Affordability remains a significant barrier for new buyers. According to the Urban Institute, at today’s rates, fewer than one in five median-income households can qualify for the median-priced home without a substantial correction in either home prices or interest costs. Zillow Housing data also shows that the typical mortgage payment has increased by nearly $1,000 since 2019, pricing many entry-level buyers out of the market.

Impact on home builders

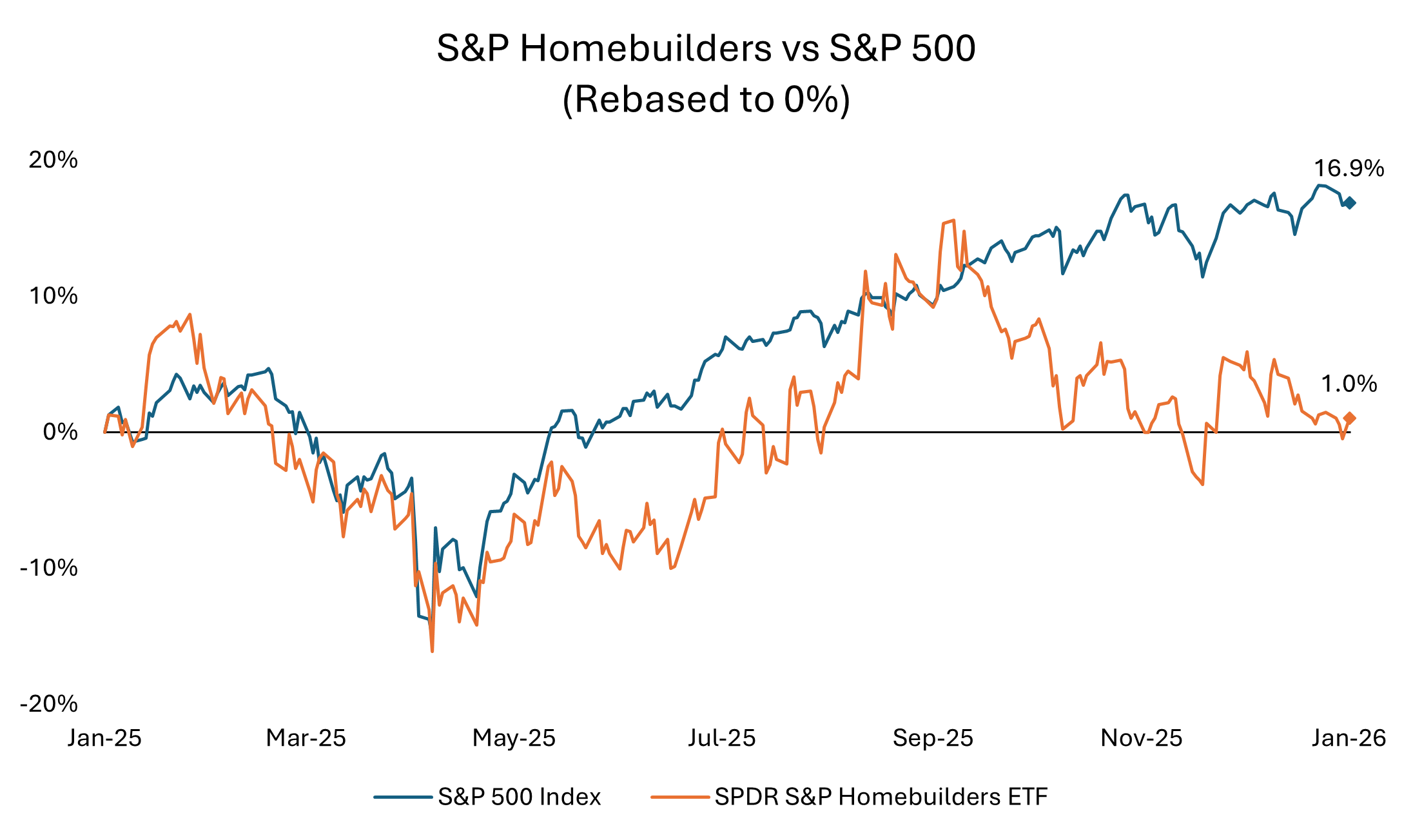

This challenging backdrop has weighed on homebuilder performance and margins. While the S&P 500 has climbed notably in 2025, the SPDR S&P Homebuilders ETF has significantly underperformed, reflecting ongoing sector-specific headwinds. Builders have responded with widespread price cuts and incentives. Based on research from the National Association of Home Builders, roughly 40% of new homes have seen discounts, and nearly 15% have sold below their previous purchase price, the highest rate in five years.

Source: LSEG Workspace

Rising input costs have squeezed profitability. Tariffs enacted in 2025 have increased material costs, with the National Association of Home Builders reporting that tariffs have added approximately $11,000 to the cost of a new home, led by steep lumber and appliance duties. Labor costs have also risen amid persistent shortages, worsened by immigration constraints and wage inflation. The 2025 U.S. Construction Outlook forecasts further material cost increases of 5-7%, exacerbating project risk and reducing builder margins.

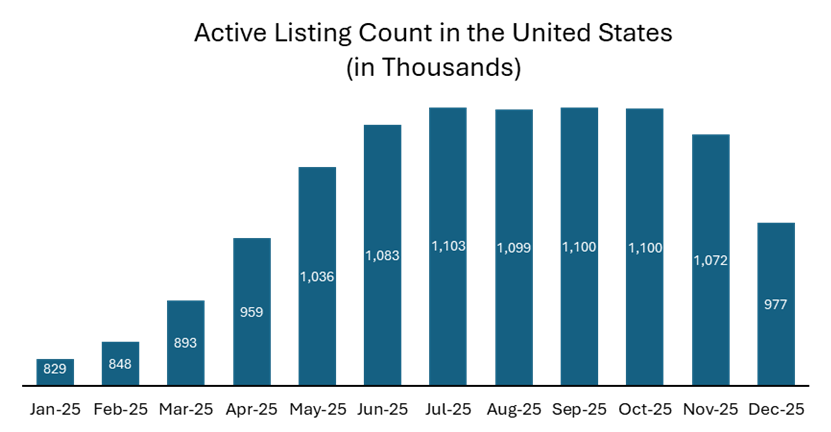

Inventory levels have increased as new home supply stood at 7.9 months in December 2025, up from pre-pandemic norms but not yet in oversupply. Existing home inventory levels peaked in June 2025 at 4.7 months and hovered at close to 3.3 months’ supply as on 2025, levels that are the highest since 2015, reflecting the lock-in effect as well as changing mobility patterns.

Source: National Association of Realtors

Policy Imperatives and Future Outlook

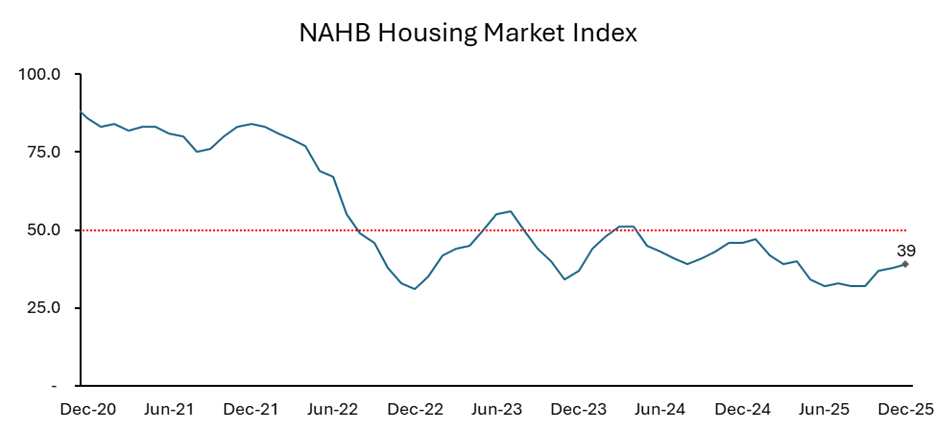

Looking forward, the near-term trajectory for homebuilders appears muted. NAHB builder sentiment indices remained in the 30s for much of 2025, reflecting negative outlooks and buyer hesitancy. A higher reading (>50) is an indication that most builders feel confident about the current and near-term outlook for housing.

Source: NAHB

Research by J.P. Morgan shows that over 80% of current borrowers are more than 1 percentage point below prevailing mortgage rates, further limiting household mobility and, thus, home sales. As a result, housing activity is likely to remain subdued through at least mid-2026, supported mainly by incentives and modest pricing adjustments.

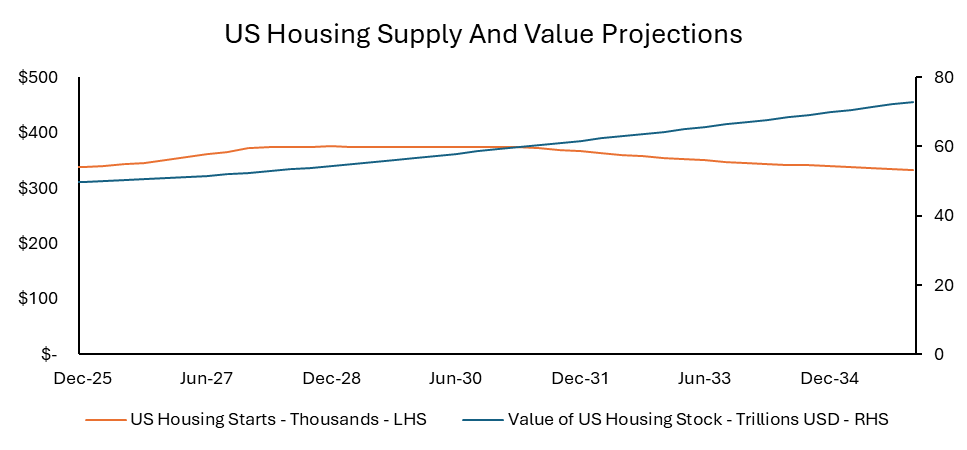

However, long-term prospects are supported by both demographic and policy fundamentals. Industry projections from Morgan Stanley indicate the U.S. will need approximately 18 million additional units by 2035 to close the supply gap caused by years of chronic underbuilding. Single-family starts are forecast to average over 1.5 million units per year from 2025 to 2029, with growth resuming as affordability improves and financing conditions normalize. Millennials and Gen Z will drive structural demand as they reach household formation milestones.

Federal policy could also play a constructive role. The proposed 2025 “ROAD to Housing Act” aims to streamline permitting, boost infrastructure funding, and support manufactured housing, all of which could unlock new supply—if enacted and implemented effectively.

Source: Oxford Economics

Investment Implications

While positive surprises such as temporary spikes in new home sales occasionally occur, the broader market remains challenged by high mortgage rates, persistent affordability issues, and tariff-driven cost increases. Investors are likely to approach homebuilder equities with caution until rate trends and input costs stabilize.

In the near term, housing-adjacent sectors may outperform. Multi-family and single-family rental platforms stand to benefit as more households rent by necessity given purchase affordability constraints. Building materials suppliers and large-scale retailers focused on remodelling and renovation—such as The Home Depot and Lowe’s —could capture growing demand from households choosing to upgrade existing homes rather than relocate. Engineering and construction firms diversified into infrastructure and commercial builds may remain resilient, offsetting any slump in residential starts.

The U.S. housing sector is marked by the confluence of steady long-term demand and short-term operational and macroeconomic headwinds. For homebuilders, overcoming today’s obstacles will require rigorous cost control, tight inventory management, and innovative approaches to affordable construction. While the sector faces ongoing challenges, especially through 2026, the pressing need for new housing creates an attractive foundation for those positioned for the eventual normalization of rates and recovery of affordability.

Contact:

Anirudh Kar, CFA

Investment Associate

anirudh@mef.bh

+973-1711 1700

Yusuf Ahmed

Sr. Investment Associate

yusuf@mef.bh

+973-1711 1700

Disclaimer: The information on this document should not be construed as legal, investment, financial, professional or any other advice. Content on this document does not represent or constitute any solicitation, inducement, recommendation, endorsement or offer by M E & F Holdings W.L.L. or any third-party service provider to buy or sell securities, commodities, digital assets, or any financial instruments. Nothing on the document constitutes professional and/or financial advice. The views expressed on this document are only of the author(s) and does not necessarily reflect the opinion of any other third party.