One of the most important rebound stories post COVID-19 is of tourism. We have seen a fundamental shift in how people perceive travel, tourism and leisure post the pandemic. Travel for leisure is becoming less of a wish and more of a need. An increasing number of people are travelling for leisure each year post pandemic and the household expenditure towards leisure and entertainment has been on the rise as well. This is despite the fact that almost all major economies of the world experienced inflation and slowing growth since early 2022. Though wage growth has been strong, its financial impact on disposable income diminishes to a meaningful impact due to rising inflation plus the steep hike in the borrowing cost we witnessed in the past two years.

Air transportation has been nearing its pre-pandemic levels of activity, with passenger traffic growing by around 40% year-on-year according to IATA reports. While the data suggests we are yet to reach the pre-COVID levels the trend up to 2023 has been encouraging.

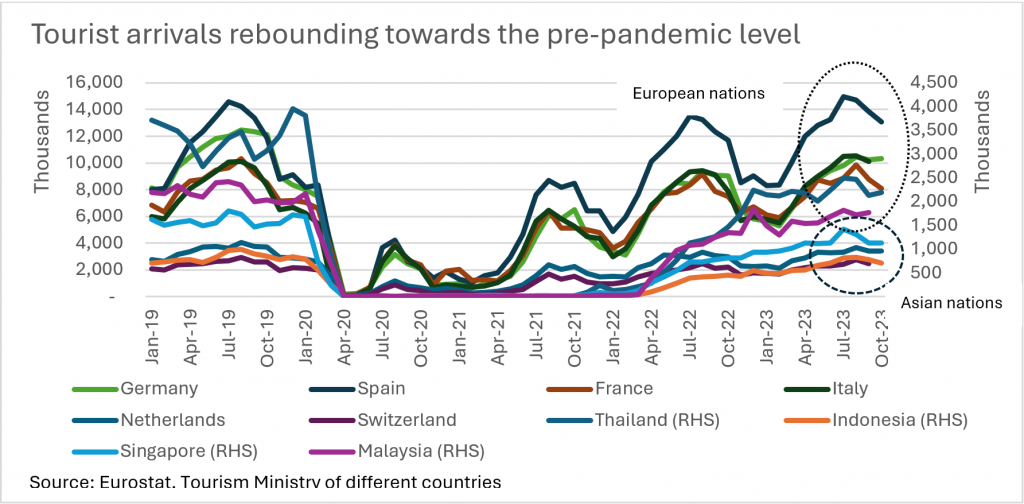

As we can notice in the below chart, the tourist arrivals for some of the key tourist destinations in the world have been increasing rapidly since 2020, however the count is just shy of early 2020 levels. We believe, against the backdrop of stabilizing inflation, tourism globally will likely reach pre-covid levels and this would trickle down to demand across the value chain such as transport, hospitality, leisure sector etc.

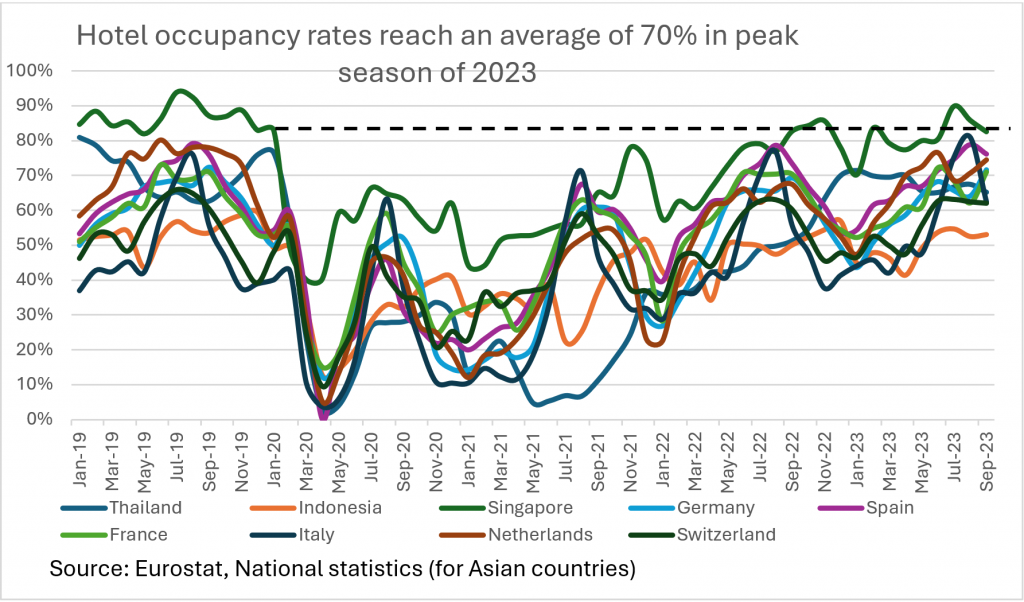

A similar trend can be seen in the hotel occupancy rates as well, the average occupancy rates across selected tourist destinations in Asia as well as Europe reached 70% in the summer months (peak season) in 2023 an improvement of 5% over the same period in 2022.

Another interesting trend is the increase in the pie of consumer spending on travel and leisure. According to Deloitte Consumer Tracker Monthly Survey, there was an average increase of 100bps in the consumer’s expected spend towards travel and leisure from 2022 to 2023.

We believe this highlights an important structural factor for tourism – people in general are more committed to taking periodic vacations and would plan and budget in advance. This in turn is due to increased awareness of work life balance, increasing popularity of remote working and rising consumption of trending information from social media, internet, blogs etc. We also believe this is a secular trend which has defended itself against headwinds like inflation and the rising cost of travel over the past two years. The emergence of experienced based travel, spiritual tourism, medical and wellness tourism and sport tourism is gaining meaningful traction along with the usual annual vacation.

The growing trend suggests the resilience of the sector towards macroeconomic headwinds has increased. Going into 2024, we believe the sector appears to be attractive with certain pockets of value.

Contact:

Jinesh Rajpara, CFA

Investment Advisor

jinesh@mef.bh

+973-1711 1703

Yusuf Ahmed

Jr. Investment Analyst

yusuf@mef.bh

+973-1711 1700

Disclaimer: The information on this document should not be construed as legal, investment, financial, professional or any other advice. Content on this document does not represent or constitute any solicitation, inducement, recommendation, endorsement or offer by M E & F Holdings W.L.L. or any third-party service provider to buy or sell securities, commodities, digital assets, or any financial instruments. Nothing on the document constitutes professional and/or financial advice. The views expressed on this document are only of the author(s) and does not necessarily reflect the opinion of any other third party.